AQR Arbitrage LLC purchased a new position in Iris Energy Limited (NASDAQ:IREN - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 100,541 shares of the company's stock, valued at approximately $987,000. AQR Arbitrage LLC owned approximately 0.05% of Iris Energy at the end of the most recent quarter.

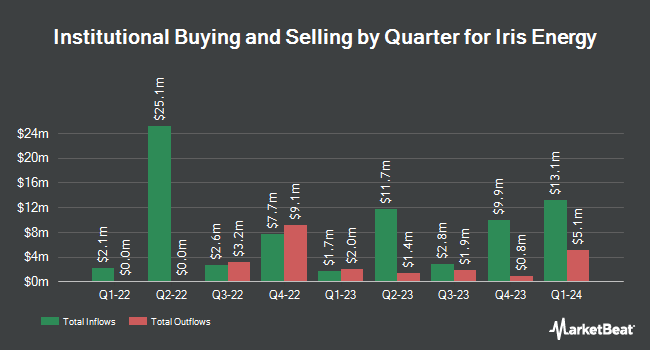

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Arrowstreet Capital Limited Partnership increased its position in shares of Iris Energy by 1,307.7% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 5,684,836 shares of the company's stock valued at $55,825,000 after acquiring an additional 5,280,999 shares during the period. Discovery Capital Management LLC CT acquired a new position in shares of Iris Energy in the fourth quarter valued at about $11,544,000. Regal Partners Ltd raised its stake in shares of Iris Energy by 93.9% in the fourth quarter. Regal Partners Ltd now owns 1,697,554 shares of the company's stock worth $16,670,000 after purchasing an additional 822,251 shares during the last quarter. Two Seas Capital LP lifted its holdings in shares of Iris Energy by 212.7% during the fourth quarter. Two Seas Capital LP now owns 860,000 shares of the company's stock worth $8,445,000 after purchasing an additional 585,000 shares during the period. Finally, Invesco Ltd. increased its holdings in Iris Energy by 22.5% in the 4th quarter. Invesco Ltd. now owns 2,311,583 shares of the company's stock worth $22,700,000 after buying an additional 424,403 shares during the period. Hedge funds and other institutional investors own 41.08% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms have weighed in on IREN. Canaccord Genuity Group lifted their price objective on Iris Energy from $17.00 to $23.00 and gave the company a "buy" rating in a research note on Thursday, February 13th. Needham & Company LLC reaffirmed a "hold" rating on shares of Iris Energy in a report on Thursday, February 13th. JPMorgan Chase & Co. raised Iris Energy from a "neutral" rating to an "overweight" rating and reduced their price objective for the company from $15.00 to $12.00 in a research note on Thursday, March 13th. HC Wainwright upped their price objective on shares of Iris Energy from $16.00 to $22.00 and gave the company a "buy" rating in a research note on Thursday, February 13th. Finally, Cantor Fitzgerald restated an "overweight" rating and set a $23.00 price objective on shares of Iris Energy in a research report on Thursday, February 13th. One research analyst has rated the stock with a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Buy" and an average target price of $20.40.

Read Our Latest Stock Report on Iris Energy

Iris Energy Stock Down 1.2 %

NASDAQ IREN traded down $0.08 during trading on Wednesday, reaching $6.43. 3,133,584 shares of the company's stock were exchanged, compared to its average volume of 15,749,615. Iris Energy Limited has a 1 year low of $4.65 and a 1 year high of $15.92. The company has a 50 day moving average price of $6.50 and a two-hundred day moving average price of $9.64.

Iris Energy (NASDAQ:IREN - Get Free Report) last announced its quarterly earnings results on Wednesday, February 12th. The company reported $0.09 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.04) by $0.13. Iris Energy had a negative return on equity of 3.98% and a negative net margin of 17.94%. On average, analysts forecast that Iris Energy Limited will post 0.43 earnings per share for the current fiscal year.

Iris Energy Company Profile

(

Free Report)

Iris Energy Limited owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

See Also

Before you consider Iris Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iris Energy wasn't on the list.

While Iris Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.