A10 Networks (NYSE:ATEN - Get Free Report) was downgraded by research analysts at Wall Street Zen from a "buy" rating to a "hold" rating in a research report issued to clients and investors on Saturday.

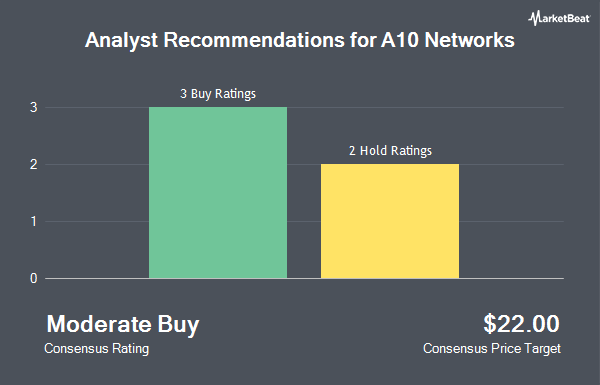

ATEN has been the subject of a number of other reports. Raymond James Financial assumed coverage on shares of A10 Networks in a research note on Wednesday, April 23rd. They issued a "market perform" rating for the company. Craig Hallum raised shares of A10 Networks from a "hold" rating to a "buy" rating and set a $20.00 target price for the company in a report on Friday, May 2nd. Deutsche Bank Aktiengesellschaft assumed coverage on shares of A10 Networks in a report on Friday, June 27th. They set a "buy" rating and a $22.00 target price for the company. Weiss Ratings reissued a "hold (c)" rating on shares of A10 Networks in a report on Thursday, July 17th. Finally, BWS Financial reaffirmed a "buy" rating and issued a $24.00 target price on shares of A10 Networks in a research report on Friday, May 2nd. Three analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, A10 Networks currently has an average rating of "Moderate Buy" and a consensus target price of $22.00.

Read Our Latest Analysis on ATEN

A10 Networks Trading Down 1.0%

ATEN stock traded down $0.18 during trading on Friday, hitting $17.99. The company had a trading volume of 166,439 shares, compared to its average volume of 966,455. The firm has a market capitalization of $1.30 billion, a P/E ratio of 26.84, a PEG ratio of 4.21 and a beta of 1.35. A10 Networks has a 52-week low of $12.27 and a 52-week high of $21.90. The company has a 50 day simple moving average of $18.41 and a 200-day simple moving average of $18.20. The company has a quick ratio of 3.87, a current ratio of 4.05 and a debt-to-equity ratio of 1.11.

Insider Buying and Selling at A10 Networks

In other A10 Networks news, General Counsel Robert Scott Weber sold 2,500 shares of the stock in a transaction that occurred on Tuesday, May 27th. The shares were sold at an average price of $17.26, for a total value of $43,150.00. Following the transaction, the general counsel directly owned 61,007 shares in the company, valued at $1,052,980.82. This represents a 3.94% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders own 1.15% of the company's stock.

Institutional Investors Weigh In On A10 Networks

Several hedge funds have recently modified their holdings of ATEN. Vestcor Inc acquired a new stake in shares of A10 Networks during the first quarter worth $44,000. Sunbelt Securities Inc. acquired a new stake in shares of A10 Networks during the fourth quarter worth $50,000. Caitong International Asset Management Co. Ltd acquired a new stake in shares of A10 Networks during the first quarter worth $55,000. CWM LLC lifted its holdings in A10 Networks by 45.6% in the first quarter. CWM LLC now owns 4,644 shares of the communications equipment provider's stock valued at $76,000 after acquiring an additional 1,454 shares during the period. Finally, DRW Securities LLC acquired a new stake in A10 Networks in the first quarter valued at $188,000. 98.61% of the stock is owned by institutional investors and hedge funds.

About A10 Networks

(

Get Free Report)

A10 Networks, Inc provides networking solutions in the Americas, Japan, rest of Asia Pacific, Europe, the Middle East, and Africa. The company offers Thunder Application Delivery Controller that provides advanced server load balancing; Thunder Carrier Grade Networking, which provides standards-compliant address and protocol translation services between varying types of internet protocol addresses; Thunder Secure Sockets Layer (SSL) Insight that decrypts SSL-encrypted traffic and forwards it to a third-party security device for deep packet inspection; and Thunder Convergent Firewall, which addresses multiple critical security capabilities in one package.

See Also

Before you consider A10 Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A10 Networks wasn't on the list.

While A10 Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.