AB Volvo (OTCMKTS:VLVLY - Get Free Report) was upgraded by equities research analysts at Sanford C. Bernstein from a "strong sell" rating to a "hold" rating in a report released on Monday,Zacks.com reports.

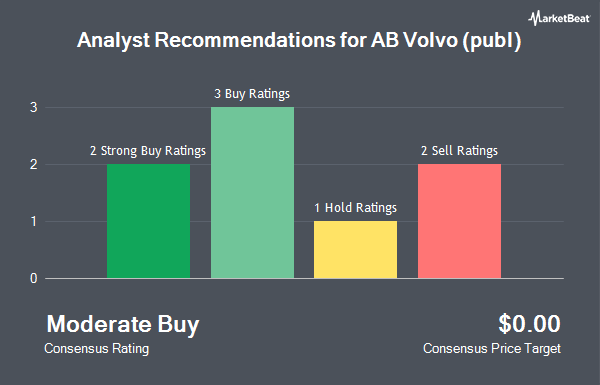

Separately, The Goldman Sachs Group downgraded shares of AB Volvo from a "buy" rating to a "neutral" rating in a research note on Monday, September 8th. One analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating, two have assigned a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat, the company has an average rating of "Moderate Buy".

Check Out Our Latest Stock Report on VLVLY

AB Volvo Trading Up 0.4%

VLVLY opened at $27.90 on Monday. The company has a debt-to-equity ratio of 0.88, a quick ratio of 0.86 and a current ratio of 1.11. The stock's 50 day moving average price is $29.57 and its 200-day moving average price is $28.18. AB Volvo has a one year low of $22.55 and a one year high of $33.33. The stock has a market cap of $56.73 billion, a price-to-earnings ratio of 13.22, a P/E/G ratio of 3.94 and a beta of 1.16.

AB Volvo (OTCMKTS:VLVLY - Get Free Report) last posted its quarterly earnings data on Thursday, July 17th. The company reported $0.69 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.53 by $0.16. AB Volvo had a return on equity of 23.77% and a net margin of 8.90%.The company had revenue of $12.59 billion during the quarter, compared to analysts' expectations of $122.35 billion. On average, equities analysts forecast that AB Volvo will post 2.38 EPS for the current year.

About AB Volvo

(

Get Free Report)

AB Volvo (publ), together with its subsidiaries, manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Europe, the United States, Asia, Africa, and Oceania. The company provides heavy-duty trucks for long-haulage and construction work and light-duty trucks for distribution purposes under the Volvo, Renault Trucks, Mack, Eicher, and Dongfeng Trucks brands; and city and intercity buses, coaches, and chassis under the Prevost and Volvo Bus brands.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AB Volvo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AB Volvo wasn't on the list.

While AB Volvo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.