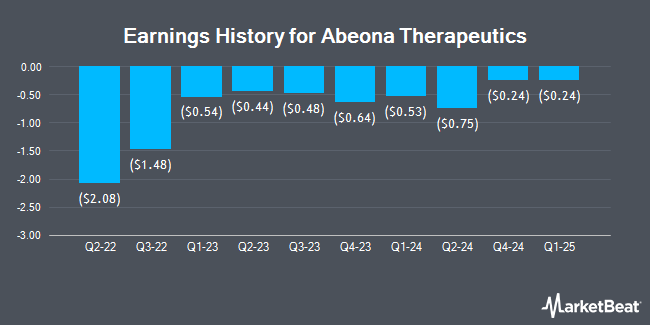

Abeona Therapeutics (NASDAQ:ABEO - Get Free Report) released its quarterly earnings data on Thursday. The biopharmaceutical company reported $1.71 EPS for the quarter, topping the consensus estimate of ($0.39) by $2.10, Zacks reports. The business had revenue of $0.40 million during the quarter, compared to the consensus estimate of $21.71 million.

Abeona Therapeutics Price Performance

ABEO traded up $0.16 on Wednesday, hitting $7.00. 1,019,168 shares of the company's stock traded hands, compared to its average volume of 1,027,478. The company's 50 day simple moving average is $6.25 and its 200-day simple moving average is $5.76. The firm has a market cap of $358.96 million, a price-to-earnings ratio of 10.00 and a beta of 1.55. Abeona Therapeutics has a one year low of $3.93 and a one year high of $7.54. The company has a current ratio of 6.73, a quick ratio of 4.90 and a debt-to-equity ratio of 0.09.

Insider Buying and Selling at Abeona Therapeutics

In other news, CFO Joseph Walter Vazzano sold 25,411 shares of the company's stock in a transaction that occurred on Wednesday, July 9th. The stock was sold at an average price of $5.86, for a total transaction of $148,908.46. Following the sale, the chief financial officer directly owned 479,168 shares of the company's stock, valued at $2,807,924.48. This represents a 5.04% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Vishwas Seshadri sold 69,420 shares of the business's stock in a transaction that occurred on Wednesday, July 9th. The shares were sold at an average price of $5.86, for a total value of $406,801.20. Following the transaction, the chief executive officer directly owned 1,234,341 shares in the company, valued at approximately $7,233,238.26. This represents a 5.32% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 231,626 shares of company stock worth $1,430,587. Company insiders own 5.40% of the company's stock.

Hedge Funds Weigh In On Abeona Therapeutics

Several large investors have recently modified their holdings of ABEO. Legal & General Group Plc bought a new stake in Abeona Therapeutics in the second quarter worth about $27,000. Man Group plc bought a new position in Abeona Therapeutics in the 2nd quarter valued at $67,000. Creative Planning grew its holdings in shares of Abeona Therapeutics by 43.0% in the second quarter. Creative Planning now owns 14,310 shares of the biopharmaceutical company's stock worth $81,000 after purchasing an additional 4,305 shares during the last quarter. The Manufacturers Life Insurance Company bought a new position in shares of Abeona Therapeutics in the second quarter worth about $96,000. Finally, New York State Common Retirement Fund bought a new position in shares of Abeona Therapeutics in the second quarter worth about $97,000. Institutional investors own 80.56% of the company's stock.

Analyst Ratings Changes

ABEO has been the subject of several research analyst reports. Stifel Nicolaus reduced their price objective on Abeona Therapeutics from $21.00 to $20.00 and set a "buy" rating for the company in a report on Friday, May 16th. HC Wainwright reissued a "buy" rating and issued a $20.00 target price on shares of Abeona Therapeutics in a research report on Monday. Wall Street Zen cut Abeona Therapeutics from a "hold" rating to a "sell" rating in a research report on Thursday, May 15th. Alliance Global Partners reissued a "buy" rating on shares of Abeona Therapeutics in a research report on Thursday, May 15th. Finally, Oppenheimer raised their target price on Abeona Therapeutics from $19.00 to $20.00 and gave the stock an "outperform" rating in a research report on Friday, August 15th. Five research analysts have rated the stock with a Buy rating, According to data from MarketBeat, Abeona Therapeutics has a consensus rating of "Buy" and an average price target of $19.50.

Read Our Latest Report on Abeona Therapeutics

About Abeona Therapeutics

(

Get Free Report)

Abeona Therapeutics Inc, a clinical-stage biopharmaceutical company, focuses on developing and delivering gene therapy products for severe and life-threatening rare diseases. The company's lead programs are EB-101 (gene-corrected skin grafts) for recessive dystrophic epidermolysis bullosa (RDEB); ABO-102, which are AAV based gene therapies for Sanfilippo syndrome type A; and ABO-101, an adeno-associated virus (AAV) based gene therapies for Sanfilippo syndrome type B.

Recommended Stories

Before you consider Abeona Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abeona Therapeutics wasn't on the list.

While Abeona Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.