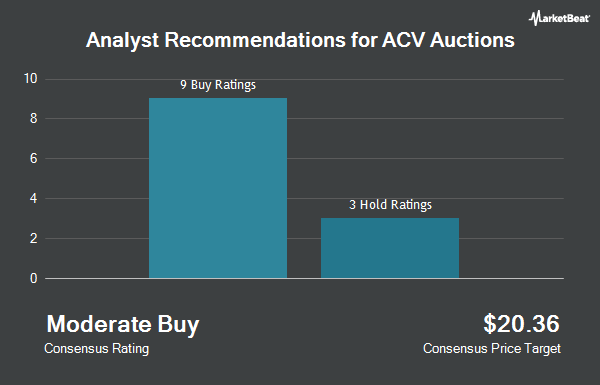

ACV Auctions Inc. (NASDAQ:ACVA - Get Free Report) has earned a consensus recommendation of "Moderate Buy" from the eleven research firms that are covering the company, Marketbeat reports. One analyst has rated the stock with a hold rating and ten have assigned a buy rating to the company. The average 1 year price objective among analysts that have covered the stock in the last year is $18.3636.

A number of analysts recently issued reports on ACVA shares. The Goldman Sachs Group decreased their target price on ACV Auctions from $26.00 to $21.00 and set a "buy" rating for the company in a research report on Tuesday, August 12th. Citigroup decreased their price objective on ACV Auctions from $21.00 to $17.00 and set a "buy" rating for the company in a report on Tuesday, August 12th. JMP Securities decreased their price target on shares of ACV Auctions from $20.00 to $18.00 and set a "market outperform" rating for the company in a research note on Tuesday, August 12th. Jefferies Financial Group decreased their price target on shares of ACV Auctions from $22.00 to $15.00 and set a "buy" rating for the company in a research note on Friday, October 17th. Finally, Stephens decreased their price target on shares of ACV Auctions from $16.00 to $11.50 and set an "equal weight" rating for the company in a research note on Tuesday, August 12th.

View Our Latest Stock Analysis on ACVA

Institutional Trading of ACV Auctions

A number of hedge funds have recently added to or reduced their stakes in the stock. Brighton Jones LLC lifted its position in ACV Auctions by 2.1% during the 2nd quarter. Brighton Jones LLC now owns 40,703 shares of the company's stock worth $660,000 after acquiring an additional 823 shares during the period. Verdence Capital Advisors LLC lifted its holdings in shares of ACV Auctions by 6.4% during the second quarter. Verdence Capital Advisors LLC now owns 15,845 shares of the company's stock worth $257,000 after purchasing an additional 960 shares during the period. Bessemer Group Inc. lifted its holdings in shares of ACV Auctions by 14.5% during the first quarter. Bessemer Group Inc. now owns 9,911 shares of the company's stock worth $140,000 after purchasing an additional 1,257 shares during the period. SG Americas Securities LLC lifted its stake in shares of ACV Auctions by 5.7% in the 2nd quarter. SG Americas Securities LLC now owns 27,302 shares of the company's stock worth $443,000 after acquiring an additional 1,467 shares during the period. Finally, Bank of Montreal Can lifted its stake in shares of ACV Auctions by 13.8% in the 2nd quarter. Bank of Montreal Can now owns 14,384 shares of the company's stock worth $233,000 after acquiring an additional 1,746 shares during the period. 88.55% of the stock is owned by institutional investors and hedge funds.

ACV Auctions Stock Performance

NASDAQ ACVA opened at $9.49 on Friday. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.56 and a quick ratio of 1.56. ACV Auctions has a 1 year low of $8.33 and a 1 year high of $23.46. The company has a market capitalization of $1.63 billion, a PE ratio of -19.36 and a beta of 1.64. The company has a fifty day moving average of $10.29 and a two-hundred day moving average of $13.59.

ACV Auctions Company Profile

(

Get Free Report)

ACV Auctions Inc operates a digital marketplace that connects buyers and sellers for the online auction of wholesale vehicles. The company's marketplace platform includes digital marketplace, which connects buyers and sellers by providing online auction, which facilitates real-time transactions of wholesale vehicles; Run List for pre-filtering and pre-screening of vehicles up to 24 hours prior to an auction taking place; ACV transportation service to enable the buyers to see real-time transportation quotes and status reports of the vehicle; ACV capital, a short-term inventory financing services for buyers to purchase vehicles; and Go Green's seller assurance service for against claims related to defects in the vehicle.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ACV Auctions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACV Auctions wasn't on the list.

While ACV Auctions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.