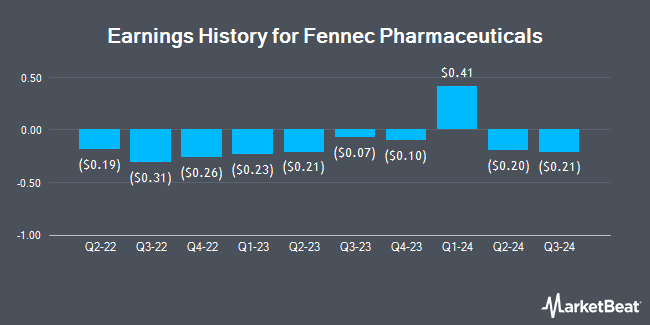

Adherex Technologies (NASDAQ:FENC - Get Free Report) released its earnings results on Thursday. The company reported ($0.11) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.06) by ($0.05), Zacks reports. The firm had revenue of $9.76 million for the quarter, compared to analyst estimates of $9.52 million.

Adherex Technologies Price Performance

Shares of FENC traded up $0.17 during mid-day trading on Wednesday, reaching $8.08. The stock had a trading volume of 67,290 shares, compared to its average volume of 56,665. Adherex Technologies has a 52-week low of $3.96 and a 52-week high of $9.42. The firm has a market cap of $224.70 million, a price-to-earnings ratio of -19.24 and a beta of 0.40. The business's fifty day moving average is $8.41 and its 200 day moving average is $7.18.

Wall Street Analysts Forecast Growth

FENC has been the topic of several research reports. HC Wainwright reissued a "buy" rating and issued a $13.00 price target on shares of Adherex Technologies in a research note on Tuesday, May 20th. Wall Street Zen upgraded shares of Adherex Technologies from a "hold" rating to a "buy" rating in a report on Sunday. Craig Hallum raised their target price on shares of Adherex Technologies from $13.00 to $14.00 and gave the stock a "buy" rating in a research note on Friday, August 15th. Finally, Zacks Research cut Adherex Technologies from a "strong-buy" rating to a "hold" rating in a report on Friday, August 15th. One investment analyst has rated the stock with a Strong Buy rating, three have assigned a Buy rating and one has assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Buy" and an average target price of $13.33.

Get Our Latest Report on FENC

Insiders Place Their Bets

In other news, Director Rosty Raykov sold 10,000 shares of the stock in a transaction that occurred on Tuesday, August 5th. The shares were sold at an average price of $8.09, for a total value of $80,900.00. Following the completion of the sale, the director owned 55,878 shares of the company's stock, valued at $452,053.02. This represents a 15.18% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. In the last quarter, insiders have sold 31,119 shares of company stock valued at $254,546. Insiders own 11.76% of the company's stock.

Institutional Inflows and Outflows

A hedge fund recently bought a new stake in Adherex Technologies stock. Jane Street Group LLC purchased a new stake in Adherex Technologies Inc. (NASDAQ:FENC - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor purchased 14,718 shares of the company's stock, valued at approximately $90,000. Jane Street Group LLC owned about 0.05% of Adherex Technologies as of its most recent SEC filing. 55.51% of the stock is owned by institutional investors and hedge funds.

About Adherex Technologies

(

Get Free Report)

Fennec Pharmaceuticals Inc, a biopharmaceutical company, develops product candidates for use in the treatment of cancer in the United States. Its lead product candidate is the Sodium Thiosulfate, which has completed the Phase III clinical trial for the prevention of cisplatin induced hearing loss or ototoxicity in children.

Featured Articles

Before you consider Adherex Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adherex Technologies wasn't on the list.

While Adherex Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.