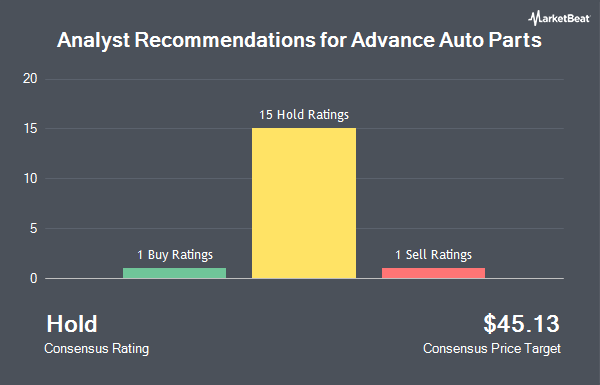

Advance Auto Parts, Inc. (NYSE:AAP - Get Free Report) has received an average recommendation of "Reduce" from the twenty-one research firms that are covering the firm, Marketbeat.com reports. Two analysts have rated the stock with a sell rating, eighteen have assigned a hold rating and one has issued a buy rating on the company. The average twelve-month price target among brokers that have issued ratings on the stock in the last year is $51.7845.

AAP has been the subject of a number of recent research reports. Mizuho lifted their price target on shares of Advance Auto Parts from $44.00 to $54.00 and gave the company a "neutral" rating in a research report on Friday, August 29th. UBS Group set a $65.00 price objective on shares of Advance Auto Parts and gave the company a "neutral" rating in a research note on Tuesday, August 12th. Redburn Partners upgraded shares of Advance Auto Parts from a "sell" rating to a "neutral" rating and set a $45.00 price objective for the company in a research note on Tuesday, June 3rd. Roth Capital set a $50.00 price objective on shares of Advance Auto Parts and gave the company a "neutral" rating in a research note on Wednesday, May 28th. Finally, DA Davidson set a $65.00 price objective on shares of Advance Auto Parts in a research note on Thursday, August 14th.

Read Our Latest Report on Advance Auto Parts

Insiders Place Their Bets

In other Advance Auto Parts news, SVP Jason Hand sold 948 shares of the firm's stock in a transaction dated Friday, June 20th. The shares were sold at an average price of $48.52, for a total transaction of $45,996.96. Following the completion of the sale, the senior vice president directly owned 9,876 shares in the company, valued at approximately $479,183.52. This trade represents a 8.76% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 0.67% of the company's stock.

Institutional Trading of Advance Auto Parts

A number of institutional investors and hedge funds have recently bought and sold shares of AAP. Hsbc Holdings PLC boosted its position in shares of Advance Auto Parts by 3.1% during the second quarter. Hsbc Holdings PLC now owns 6,306 shares of the company's stock worth $293,000 after acquiring an additional 191 shares during the last quarter. Rockefeller Capital Management L.P. boosted its position in shares of Advance Auto Parts by 2.0% during the second quarter. Rockefeller Capital Management L.P. now owns 14,535 shares of the company's stock worth $676,000 after acquiring an additional 283 shares during the last quarter. Central Pacific Bank Trust Division boosted its position in shares of Advance Auto Parts by 10.0% during the first quarter. Central Pacific Bank Trust Division now owns 3,300 shares of the company's stock worth $129,000 after acquiring an additional 300 shares during the last quarter. KLP Kapitalforvaltning AS lifted its position in Advance Auto Parts by 2.5% during the second quarter. KLP Kapitalforvaltning AS now owns 12,500 shares of the company's stock valued at $581,000 after purchasing an additional 300 shares during the last quarter. Finally, Capital Square LLC lifted its position in Advance Auto Parts by 4.3% during the second quarter. Capital Square LLC now owns 7,265 shares of the company's stock valued at $338,000 after purchasing an additional 300 shares during the last quarter. 88.70% of the stock is currently owned by institutional investors.

Advance Auto Parts Stock Up 0.5%

NYSE AAP traded up $0.32 during trading hours on Wednesday, reaching $60.38. 880,122 shares of the company's stock traded hands, compared to its average volume of 1,719,965. Advance Auto Parts has a 52-week low of $28.89 and a 52-week high of $70.00. The firm has a market cap of $3.62 billion, a PE ratio of -9.48 and a beta of 1.06. The firm has a 50-day simple moving average of $58.07 and a 200 day simple moving average of $45.86. The company has a debt-to-equity ratio of 0.68, a current ratio of 1.27 and a quick ratio of 0.49.

Advance Auto Parts (NYSE:AAP - Get Free Report) last issued its quarterly earnings results on Thursday, August 14th. The company reported $0.69 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.59 by $0.10. Advance Auto Parts had a negative net margin of 4.37% and a negative return on equity of 1.97%. The company had revenue of $2.01 billion during the quarter, compared to analysts' expectations of $1.97 billion. During the same period last year, the company posted $0.75 EPS. Advance Auto Parts's revenue was down 7.7% on a year-over-year basis. Advance Auto Parts has set its FY 2025 guidance at 1.200-2.20 EPS. Sell-side analysts anticipate that Advance Auto Parts will post -0.46 EPS for the current fiscal year.

Advance Auto Parts Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, October 24th. Shareholders of record on Friday, October 10th will be paid a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a yield of 1.7%. The ex-dividend date is Friday, October 10th. Advance Auto Parts's dividend payout ratio (DPR) is currently -15.70%.

About Advance Auto Parts

(

Get Free Report)

Advance Auto Parts, Inc provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks. The company offers battery accessories; belts and hoses; brakes and brake pads; chassis and climate control parts; clutches and drive shafts; engines and engine parts; exhaust systems and parts; hub assemblies; ignition components and wires; radiators and cooling parts; starters and alternators; and steering and alignment parts.

See Also

Before you consider Advance Auto Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advance Auto Parts wasn't on the list.

While Advance Auto Parts currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.