Affirm (NASDAQ:AFRM - Get Free Report) was upgraded by stock analysts at Wall Street Zen from a "hold" rating to a "buy" rating in a research note issued on Saturday.

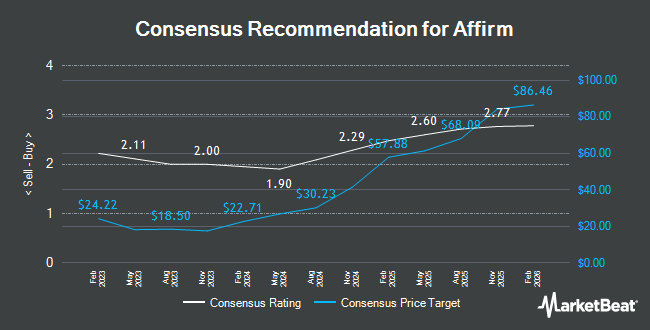

AFRM has been the topic of a number of other reports. Citigroup restated an "overweight" rating on shares of Affirm in a research report on Monday, June 30th. Barclays boosted their price target on shares of Affirm from $67.00 to $80.00 and gave the company an "overweight" rating in a research report on Monday, June 30th. Rothschild & Co Redburn began coverage on shares of Affirm in a research report on Friday, August 1st. They issued a "neutral" rating and a $74.00 price target on the stock. Oppenheimer set a $80.00 price target on shares of Affirm and gave the company an "outperform" rating in a research report on Monday, July 21st. Finally, Morgan Stanley reduced their price target on shares of Affirm from $65.00 to $60.00 and set an "equal weight" rating on the stock in a research report on Tuesday, May 6th. Ten research analysts have rated the stock with a hold rating, nineteen have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $68.09.

Check Out Our Latest Analysis on Affirm

Affirm Price Performance

Shares of Affirm stock opened at $72.33 on Friday. The company has a debt-to-equity ratio of 2.55, a quick ratio of 11.47 and a current ratio of 11.47. The firm's 50-day simple moving average is $65.69 and its 200-day simple moving average is $57.73. Affirm has a twelve month low of $24.67 and a twelve month high of $82.53. The firm has a market cap of $23.33 billion, a P/E ratio of -344.43, a price-to-earnings-growth ratio of 2.92 and a beta of 3.63.

Affirm (NASDAQ:AFRM - Get Free Report) last released its quarterly earnings results on Thursday, May 8th. The company reported $0.01 EPS for the quarter, beating analysts' consensus estimates of ($0.09) by $0.10. The firm had revenue of $783.14 million for the quarter, compared to analyst estimates of $782.98 million. Affirm had a negative net margin of 2.07% and a negative return on equity of 2.22%. The company's revenue for the quarter was up 35.9% compared to the same quarter last year. During the same period in the previous year, the business earned ($0.43) earnings per share. As a group, research analysts expect that Affirm will post -0.18 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, CAO Siphelele Jiyane sold 15,871 shares of the stock in a transaction that occurred on Monday, August 4th. The shares were sold at an average price of $75.00, for a total value of $1,190,325.00. Following the transaction, the chief accounting officer directly owned 242,192 shares in the company, valued at $18,164,400. This represents a 6.15% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Christa S. Quarles sold 754 shares of the stock in a transaction that occurred on Tuesday, July 1st. The shares were sold at an average price of $67.43, for a total transaction of $50,842.22. Following the completion of the transaction, the director owned 137,241 shares in the company, valued at $9,254,160.63. This represents a 0.55% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 163,114 shares of company stock valued at $11,825,169 over the last three months. 11.82% of the stock is owned by insiders.

Institutional Investors Weigh In On Affirm

Several hedge funds have recently bought and sold shares of the company. Capital Research Global Investors raised its holdings in Affirm by 2.0% in the fourth quarter. Capital Research Global Investors now owns 24,264,396 shares of the company's stock worth $1,477,747,000 after purchasing an additional 470,409 shares during the period. Vanguard Group Inc. raised its holdings in Affirm by 6.7% in the first quarter. Vanguard Group Inc. now owns 23,272,997 shares of the company's stock worth $1,051,707,000 after purchasing an additional 1,457,434 shares during the period. Capital World Investors raised its holdings in Affirm by 0.4% in the fourth quarter. Capital World Investors now owns 18,339,165 shares of the company's stock worth $1,116,861,000 after purchasing an additional 72,582 shares during the period. Durable Capital Partners LP raised its holdings in Affirm by 12.3% in the first quarter. Durable Capital Partners LP now owns 6,580,882 shares of the company's stock worth $297,390,000 after purchasing an additional 722,599 shares during the period. Finally, Jericho Capital Asset Management L.P. raised its holdings in Affirm by 11.6% in the fourth quarter. Jericho Capital Asset Management L.P. now owns 5,198,039 shares of the company's stock worth $316,561,000 after purchasing an additional 538,892 shares during the period. 69.29% of the stock is currently owned by institutional investors and hedge funds.

Affirm Company Profile

(

Get Free Report)

Affirm Holdings, Inc operates a platform for digital and mobile-first commerce in the United States, Canada, and internationally. The company's platform includes point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Its commerce platform, agreements with originating banks, and capital markets partners enables consumers to pay for a purchase over time with terms ranging up to 60 months.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Affirm, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Affirm wasn't on the list.

While Affirm currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.