Afya (NASDAQ:AFYA - Get Free Report) was upgraded by analysts at UBS Group from a "neutral" rating to a "buy" rating in a report issued on Monday, Marketbeat.com reports. The firm presently has a $19.00 price objective on the stock, down from their previous price objective of $19.50. UBS Group's price target indicates a potential upside of 21.79% from the company's previous close.

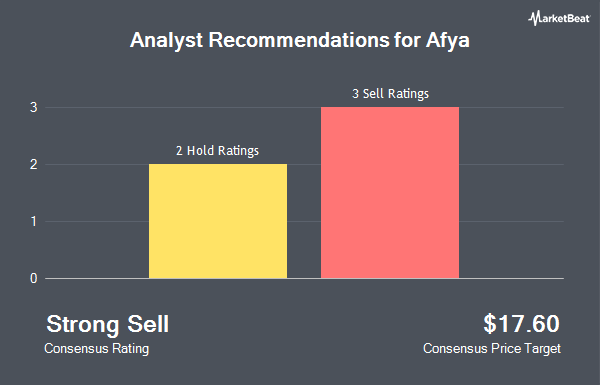

Several other equities analysts have also recently commented on AFYA. Zacks Research upgraded Afya to a "hold" rating in a research report on Friday, August 8th. Morgan Stanley set a $17.50 target price on Afya and gave the company an "overweight" rating in a report on Wednesday, August 6th. Citigroup raised Afya from a "sell" rating to a "neutral" rating and lowered their price target for the company from $16.00 to $14.00 in a research report on Tuesday, July 29th. Finally, Wall Street Zen raised Afya from a "hold" rating to a "buy" rating in a research report on Friday, August 22nd. Three research analysts have rated the stock with a Buy rating, two have issued a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat.com, Afya currently has an average rating of "Hold" and an average price target of $18.20.

Get Our Latest Report on Afya

Afya Stock Performance

Shares of AFYA traded down $0.11 during mid-day trading on Monday, hitting $15.60. The stock had a trading volume of 87,273 shares, compared to its average volume of 80,529. The firm has a market cap of $1.46 billion, a P/E ratio of 11.82, a PEG ratio of 0.54 and a beta of 0.56. The business has a fifty day moving average price of $15.06 and a 200-day moving average price of $16.98. The company has a debt-to-equity ratio of 0.22, a current ratio of 0.94 and a quick ratio of 0.94. Afya has a 52 week low of $13.47 and a 52 week high of $19.90.

Institutional Trading of Afya

Several institutional investors have recently added to or reduced their stakes in AFYA. Wellington Management Group LLP purchased a new position in shares of Afya in the 4th quarter worth $829,000. BNP Paribas Financial Markets bought a new stake in Afya during the fourth quarter valued at about $228,000. Cerity Partners LLC bought a new stake in shares of Afya in the first quarter worth about $476,000. Yorktown Management & Research Co Inc bought a new stake in Afya during the first quarter worth approximately $321,000. Finally, Two Sigma Advisers LP boosted its position in shares of Afya by 27.2% during the fourth quarter. Two Sigma Advisers LP now owns 78,600 shares of the company's stock valued at $1,248,000 after buying an additional 16,800 shares during the period. 88.02% of the stock is currently owned by hedge funds and other institutional investors.

Afya Company Profile

(

Get Free Report)

Afya Limited, through its subsidiaries, operates as a medical education group in Brazil. The company operates through three segments: Undergrad, Continuing Education, and Digital Services. It offers educational products and services, including medical schools, medical residency preparatory courses, graduate courses, and other programs to lifelong medical learners enrolled across its distribution network, as well as to third-party medical schools.

Featured Articles

Before you consider Afya, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Afya wasn't on the list.

While Afya currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.