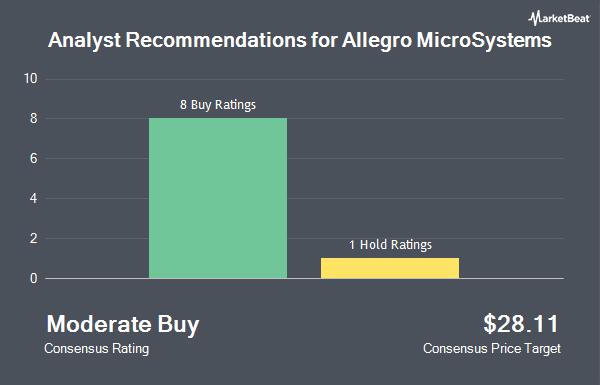

Shares of Allegro MicroSystems, Inc. (NASDAQ:ALGM - Get Free Report) have earned an average recommendation of "Buy" from the nine brokerages that are presently covering the stock, Marketbeat.com reports. One equities research analyst has rated the stock with a hold recommendation, seven have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month price objective among analysts that have updated their coverage on the stock in the last year is $37.56.

Several equities research analysts have weighed in on ALGM shares. Morgan Stanley cut their target price on Allegro MicroSystems from $38.00 to $35.00 and set an "equal weight" rating for the company in a research note on Friday. Mizuho upped their target price on Allegro MicroSystems from $37.00 to $40.00 and gave the stock an "outperform" rating in a research note on Friday. Needham & Company LLC upped their target price on Allegro MicroSystems from $25.00 to $37.00 and gave the stock a "buy" rating in a research note on Thursday. Barclays upped their target price on Allegro MicroSystems from $23.00 to $30.00 and gave the stock an "overweight" rating in a research note on Friday. Finally, Wall Street Zen upgraded shares of Allegro MicroSystems from a "hold" rating to a "buy" rating in a report on Saturday.

Check Out Our Latest Stock Report on Allegro MicroSystems

Hedge Funds Weigh In On Allegro MicroSystems

Several institutional investors have recently made changes to their positions in ALGM. Fifth Third Bancorp grew its holdings in shares of Allegro MicroSystems by 63.7% during the first quarter. Fifth Third Bancorp now owns 1,295 shares of the company's stock valued at $33,000 after buying an additional 504 shares during the last quarter. UMB Bank n.a. increased its holdings in shares of Allegro MicroSystems by 68.6% in the first quarter. UMB Bank n.a. now owns 1,420 shares of the company's stock valued at $36,000 after purchasing an additional 578 shares during the period. TD Waterhouse Canada Inc. purchased a new position in Allegro MicroSystems during the 4th quarter worth approximately $40,000. DekaBank Deutsche Girozentrale purchased a new position in Allegro MicroSystems during the 1st quarter worth approximately $71,000. Finally, Nisa Investment Advisors LLC raised its position in Allegro MicroSystems by 158.8% during the 2nd quarter. Nisa Investment Advisors LLC now owns 2,210 shares of the company's stock worth $76,000 after buying an additional 1,356 shares during the last quarter. Hedge funds and other institutional investors own 56.45% of the company's stock.

Allegro MicroSystems Stock Down 0.5%

Shares of ALGM opened at $31.26 on Monday. The firm has a market capitalization of $5.78 billion, a price-to-earnings ratio of -84.48 and a beta of 1.74. The company has a debt-to-equity ratio of 0.34, a quick ratio of 2.26 and a current ratio of 3.70. The business's fifty day moving average price is $32.27 and its two-hundred day moving average price is $26.70. Allegro MicroSystems has a 52 week low of $16.38 and a 52 week high of $38.45.

Allegro MicroSystems (NASDAQ:ALGM - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The company reported $0.09 EPS for the quarter, meeting the consensus estimate of $0.09. Allegro MicroSystems had a negative net margin of 9.00% and a positive return on equity of 2.09%. The business had revenue of $203.41 million for the quarter, compared to analysts' expectations of $197.82 million. During the same period in the previous year, the firm posted $0.03 EPS. The firm's revenue was up 21.9% compared to the same quarter last year. On average, analysts predict that Allegro MicroSystems will post 0.01 earnings per share for the current year.

About Allegro MicroSystems

(

Get Free ReportAllegro MicroSystems, Inc, together with its subsidiaries, designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems. Its products include magnetic sensor ICs, such as position, speed, and current sensor ICs; and power ICs comprising motor driver ICs, regulator and LED driver ICs, and isolated gate drivers.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Allegro MicroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegro MicroSystems wasn't on the list.

While Allegro MicroSystems currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.