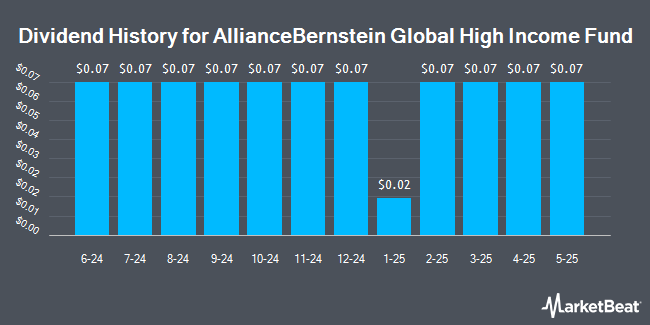

AllianceBernstein Global High Income Fund, Inc. (NYSE:AWF - Get Free Report) declared a monthly dividend on Wednesday, October 22nd. Shareholders of record on Thursday, November 6th will be given a dividend of 0.0655 per share by the closed-end fund on Friday, November 21st. This represents a c) annualized dividend and a yield of 7.1%. The ex-dividend date is Thursday, November 6th.

AllianceBernstein Global High Income Fund Trading Up 0.3%

AllianceBernstein Global High Income Fund stock opened at $11.07 on Thursday. The stock has a fifty day moving average price of $11.18 and a two-hundred day moving average price of $10.90. AllianceBernstein Global High Income Fund has a 52-week low of $9.30 and a 52-week high of $11.43.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of the stock. Gridiron Partners LLC acquired a new position in AllianceBernstein Global High Income Fund during the third quarter worth $463,000. Huntleigh Advisors Inc. acquired a new stake in shares of AllianceBernstein Global High Income Fund in the first quarter valued at $13,519,000. Royal Bank of Canada increased its stake in shares of AllianceBernstein Global High Income Fund by 1.0% in the first quarter. Royal Bank of Canada now owns 1,072,359 shares of the closed-end fund's stock valued at $11,507,000 after buying an additional 11,022 shares in the last quarter. Invesco Ltd. increased its stake in shares of AllianceBernstein Global High Income Fund by 22.5% in the first quarter. Invesco Ltd. now owns 1,058,145 shares of the closed-end fund's stock valued at $11,354,000 after buying an additional 194,351 shares in the last quarter. Finally, LPL Financial LLC increased its stake in shares of AllianceBernstein Global High Income Fund by 3.9% in the first quarter. LPL Financial LLC now owns 960,855 shares of the closed-end fund's stock valued at $10,310,000 after buying an additional 35,714 shares in the last quarter.

About AllianceBernstein Global High Income Fund

(

Get Free Report)

AllianceBernstein Global High Income Fund is a close-ended fixed income mutual fund launched and managed by AllianceBernstein L.P. It invests in fixed income markets across the globe. The fund primarily invests in lower-rated corporate debt securities and government bonds. It employs a combination of fundamental and quantitative analysis to create its portfolio.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AllianceBernstein Global High Income Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AllianceBernstein Global High Income Fund wasn't on the list.

While AllianceBernstein Global High Income Fund currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.