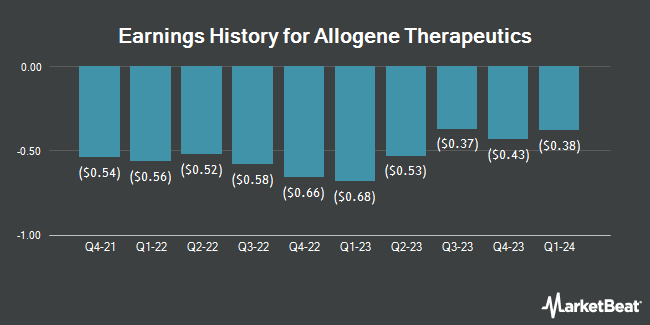

Allogene Therapeutics (NASDAQ:ALLO - Get Free Report) is expected to release its earnings data before the market opens on Wednesday, August 6th. Analysts expect Allogene Therapeutics to post earnings of ($0.28) per share for the quarter.

Allogene Therapeutics (NASDAQ:ALLO - Get Free Report) last posted its quarterly earnings results on Tuesday, May 13th. The company reported ($0.28) earnings per share for the quarter, hitting analysts' consensus estimates of ($0.28). On average, analysts expect Allogene Therapeutics to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Allogene Therapeutics Trading Down 12.2%

ALLO traded down $0.15 during trading on Friday, hitting $1.08. 19,087,454 shares of the company traded hands, compared to its average volume of 4,806,039. The company has a market cap of $236.23 million, a PE ratio of -0.88 and a beta of 0.35. Allogene Therapeutics has a 1 year low of $0.86 and a 1 year high of $3.78. The stock's 50-day simple moving average is $1.28 and its two-hundred day simple moving average is $1.51.

Institutional Inflows and Outflows

A number of large investors have recently bought and sold shares of ALLO. AQR Capital Management LLC acquired a new stake in shares of Allogene Therapeutics during the first quarter worth about $85,000. Jane Street Group LLC boosted its position in shares of Allogene Therapeutics by 578.7% during the 1st quarter. Jane Street Group LLC now owns 1,116,681 shares of the company's stock worth $1,630,000 after purchasing an additional 952,158 shares in the last quarter. Finally, Goldman Sachs Group Inc. increased its position in shares of Allogene Therapeutics by 177.9% in the first quarter. Goldman Sachs Group Inc. now owns 5,853,974 shares of the company's stock valued at $8,547,000 after buying an additional 3,747,397 shares in the last quarter. Institutional investors and hedge funds own 83.63% of the company's stock.

Wall Street Analyst Weigh In

Several research firms have recently issued reports on ALLO. Oppenheimer lowered their target price on shares of Allogene Therapeutics from $10.00 to $9.00 and set an "outperform" rating for the company in a report on Wednesday, May 14th. Piper Sandler lowered their target price on shares of Allogene Therapeutics from $9.00 to $7.00 and set an "overweight" rating for the company in a report on Wednesday, May 14th. Citizens Jmp downgraded shares of Allogene Therapeutics from an "outperform" rating to a "market perform" rating in a research note on Wednesday, May 14th. Truist Financial reduced their price target on shares of Allogene Therapeutics from $14.00 to $10.00 and set a "buy" rating on the stock in a research note on Wednesday, May 14th. Finally, Robert W. Baird reduced their price target on shares of Allogene Therapeutics from $12.00 to $9.00 and set an "outperform" rating on the stock in a research note on Wednesday, May 14th. One investment analyst has rated the stock with a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $8.44.

View Our Latest Stock Analysis on ALLO

Allogene Therapeutics Company Profile

(

Get Free Report)

Allogene Therapeutics, Inc, a clinical stage immuno-oncology company, develops and commercializes genetically engineered allogeneic T cell therapies for the treatment of cancer. It develops, manufactures, and commercializes UCART19, an allogeneic chimeric antigen receptor (CAR) T cell product candidate for the treatment of pediatric and adult patients with R/R CD19 positive B-cell acute lymphoblastic leukemia (ALL).

Read More

Before you consider Allogene Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allogene Therapeutics wasn't on the list.

While Allogene Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.