Alphabet (NASDAQ:GOOGL - Get Free Report) had its target price lifted by stock analysts at Citizens Jmp from $250.00 to $290.00 in a report released on Friday,MarketScreener reports. The firm currently has an "outperform" rating on the information services provider's stock. Citizens Jmp's target price indicates a potential upside of 14.84% from the company's current price.

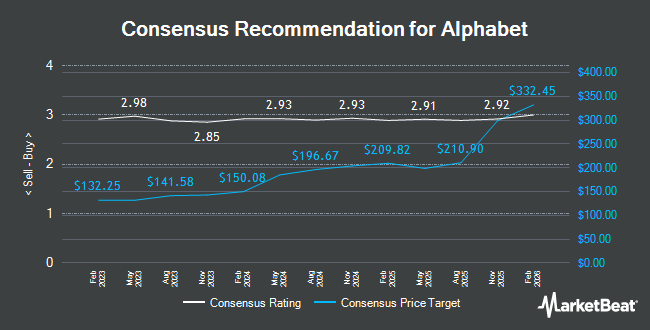

Several other analysts have also recently issued reports on the stock. Wells Fargo & Company upped their target price on shares of Alphabet from $184.00 to $187.00 and gave the company an "equal weight" rating in a research report on Tuesday, July 29th. Canaccord Genuity Group upped their target price on shares of Alphabet from $230.00 to $270.00 and gave the company a "buy" rating in a research report on Thursday, September 4th. Wall Street Zen cut shares of Alphabet from a "buy" rating to a "hold" rating in a research report on Sunday. Tigress Financial upped their target price on shares of Alphabet from $240.00 to $280.00 and gave the company a "strong-buy" rating in a research report on Friday, September 5th. Finally, Barclays upped their target price on shares of Alphabet from $235.00 to $250.00 and gave the company an "overweight" rating in a research report on Wednesday, September 3rd. Three investment analysts have rated the stock with a Strong Buy rating, thirty-two have given a Buy rating and ten have issued a Hold rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $231.31.

Check Out Our Latest Stock Analysis on Alphabet

Alphabet Price Performance

GOOGL stock traded down $2.19 during mid-day trading on Friday, hitting $252.53. The company had a trading volume of 32,240,768 shares, compared to its average volume of 38,953,800. The company has a market capitalization of $3.05 trillion, a price-to-earnings ratio of 26.89, a P/E/G ratio of 1.72 and a beta of 1.01. Alphabet has a 12-month low of $140.53 and a 12-month high of $256.00. The company has a quick ratio of 1.90, a current ratio of 1.90 and a debt-to-equity ratio of 0.07. The company has a 50-day moving average price of $210.78 and a 200 day moving average price of $180.96.

Alphabet (NASDAQ:GOOGL - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The information services provider reported $2.31 earnings per share for the quarter, beating analysts' consensus estimates of $2.15 by $0.16. Alphabet had a net margin of 31.12% and a return on equity of 34.31%. The firm had revenue of $96.43 billion during the quarter, compared to analyst estimates of $93.60 billion. On average, research analysts anticipate that Alphabet will post 8.9 earnings per share for the current year.

Insider Activity at Alphabet

In other Alphabet news, CAO Amie Thuener O'toole sold 2,778 shares of the company's stock in a transaction dated Monday, September 15th. The shares were sold at an average price of $245.00, for a total value of $680,610.00. Following the transaction, the chief accounting officer directly owned 17,293 shares in the company, valued at $4,236,785. This represents a 13.84% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider John Kent Walker sold 23,820 shares of the company's stock in a transaction dated Monday, August 4th. The stock was sold at an average price of $194.70, for a total transaction of $4,637,754.00. Following the completion of the transaction, the insider owned 42,999 shares in the company, valued at $8,371,905.30. This represents a 35.65% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 258,088 shares of company stock valued at $52,405,304 over the last 90 days. 11.55% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Alphabet

A number of hedge funds have recently added to or reduced their stakes in the stock. Norges Bank purchased a new stake in shares of Alphabet in the 2nd quarter worth approximately $21,944,208,000. Nuveen LLC purchased a new stake in shares of Alphabet in the 1st quarter worth approximately $4,317,606,000. GAMMA Investing LLC lifted its position in shares of Alphabet by 16,993.2% in the 1st quarter. GAMMA Investing LLC now owns 16,062,457 shares of the information services provider's stock worth $2,483,898,000 after purchasing an additional 15,968,487 shares during the period. Laurel Wealth Advisors LLC lifted its position in shares of Alphabet by 17,667.7% in the 2nd quarter. Laurel Wealth Advisors LLC now owns 15,245,075 shares of the information services provider's stock worth $2,686,640,000 after purchasing an additional 15,159,273 shares during the period. Finally, Vanguard Group Inc. lifted its position in shares of Alphabet by 2.9% in the 1st quarter. Vanguard Group Inc. now owns 509,826,331 shares of the information services provider's stock worth $78,839,544,000 after purchasing an additional 14,307,345 shares during the period. 40.03% of the stock is currently owned by institutional investors.

Alphabet Company Profile

(

Get Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Read More

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report