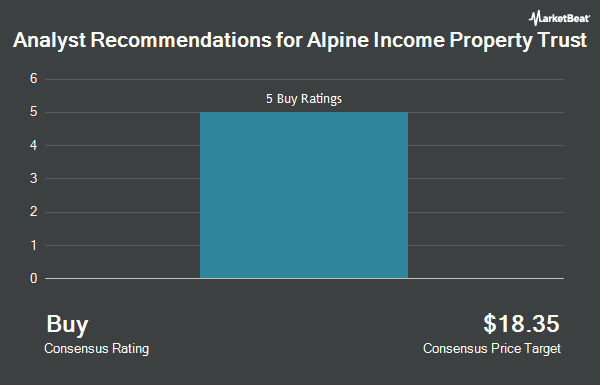

Shares of Alpine Income Property Trust, Inc. (NYSE:PINE - Get Free Report) have earned an average rating of "Moderate Buy" from the five research firms that are covering the stock, Marketbeat Ratings reports. One research analyst has rated the stock with a hold recommendation and four have assigned a buy recommendation to the company. The average 12-month price objective among analysts that have issued ratings on the stock in the last year is $18.4167.

Several research analysts have commented on the stock. Stifel Nicolaus decreased their target price on shares of Alpine Income Property Trust from $18.50 to $17.50 and set a "buy" rating for the company in a report on Friday, July 25th. Alliance Global Partners reiterated a "buy" rating on shares of Alpine Income Property Trust in a report on Friday, July 25th. Jones Trading decreased their target price on shares of Alpine Income Property Trust from $20.00 to $19.00 and set a "buy" rating for the company in a report on Friday, July 25th. Finally, UBS Group decreased their target price on shares of Alpine Income Property Trust from $16.00 to $15.00 and set a "neutral" rating for the company in a report on Wednesday, July 16th.

Get Our Latest Research Report on PINE

Alpine Income Property Trust Price Performance

NYSE PINE traded up $0.08 on Friday, reaching $15.21. The company's stock had a trading volume of 50,636 shares, compared to its average volume of 67,294. Alpine Income Property Trust has a twelve month low of $13.95 and a twelve month high of $19.29. The company has a debt-to-equity ratio of 1.40, a quick ratio of 0.85 and a current ratio of 0.85. The stock has a market cap of $215.39 million, a PE ratio of -304.22, a PEG ratio of 1.43 and a beta of 0.64. The firm's 50 day moving average is $14.64 and its two-hundred day moving average is $15.37.

Alpine Income Property Trust Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Thursday, September 11th will be issued a $0.285 dividend. This represents a $1.14 annualized dividend and a dividend yield of 7.5%. The ex-dividend date is Thursday, September 11th. Alpine Income Property Trust's dividend payout ratio (DPR) is presently -2,280.00%.

Insider Activity at Alpine Income Property Trust

In related news, CEO John P. Albright purchased 3,500 shares of the firm's stock in a transaction that occurred on Wednesday, August 6th. The stock was acquired at an average cost of $14.20 per share, for a total transaction of $49,700.00. Following the completion of the acquisition, the chief executive officer owned 11,444 shares in the company, valued at $162,504.80. This trade represents a 44.06% increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 0.46% of the company's stock.

Institutional Trading of Alpine Income Property Trust

A number of institutional investors have recently added to or reduced their stakes in PINE. Ameriprise Financial Inc. raised its holdings in Alpine Income Property Trust by 13.1% in the 2nd quarter. Ameriprise Financial Inc. now owns 15,620 shares of the company's stock worth $230,000 after acquiring an additional 1,810 shares during the period. Qube Research & Technologies Ltd raised its holdings in Alpine Income Property Trust by 43.4% in the 2nd quarter. Qube Research & Technologies Ltd now owns 39,848 shares of the company's stock worth $586,000 after acquiring an additional 12,063 shares during the period. Gabelli Funds LLC bought a new position in Alpine Income Property Trust in the 2nd quarter worth $3,621,000. Gamco Investors INC. ET AL bought a new position in Alpine Income Property Trust in the 2nd quarter worth $467,000. Finally, Hsbc Holdings PLC raised its holdings in Alpine Income Property Trust by 42.3% in the 2nd quarter. Hsbc Holdings PLC now owns 27,866 shares of the company's stock worth $412,000 after acquiring an additional 8,278 shares during the period. 60.50% of the stock is currently owned by institutional investors and hedge funds.

About Alpine Income Property Trust

(

Get Free Report)

Alpine Income Property Trust, Inc NYSE: PINE is a publicly traded real estate investment trust that seeks to deliver attractive risk-adjusted returns and dependable cash dividends by investing in, owning and operating a portfolio of single tenant net leased properties that are predominately leased to high-quality publicly traded and credit-rated tenants.

Featured Stories

Before you consider Alpine Income Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alpine Income Property Trust wasn't on the list.

While Alpine Income Property Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.