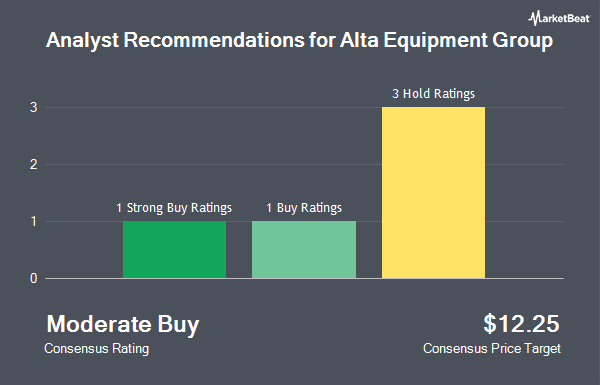

Alta Equipment Group Inc. (NYSE:ALTG - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the six research firms that are currently covering the stock, Marketbeat reports. One research analyst has rated the stock with a sell rating, two have given a hold rating, one has given a buy rating and two have assigned a strong buy rating to the company. The average 12-month price objective among analysts that have issued a report on the stock in the last year is $11.25.

Several equities analysts have commented on ALTG shares. Northland Securities upgraded shares of Alta Equipment Group from a "market perform" rating to an "outperform" rating and set a $20.00 price objective for the company in a research report on Tuesday, July 8th. Weiss Ratings reiterated a "sell (d-)" rating on shares of Alta Equipment Group in a research report on Wednesday. DA Davidson reiterated a "neutral" rating and set a $8.00 price objective on shares of Alta Equipment Group in a research report on Monday, August 18th. Finally, Northland Capmk raised shares of Alta Equipment Group from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, July 8th.

View Our Latest Research Report on ALTG

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the stock. Farther Finance Advisors LLC increased its stake in Alta Equipment Group by 1,279.1% in the 2nd quarter. Farther Finance Advisors LLC now owns 5,806 shares of the company's stock worth $37,000 after buying an additional 5,385 shares during the period. Rhumbline Advisers increased its stake in Alta Equipment Group by 15.9% in the 1st quarter. Rhumbline Advisers now owns 39,374 shares of the company's stock worth $185,000 after buying an additional 5,406 shares during the period. Raymond James Financial Inc. purchased a new position in Alta Equipment Group in the 2nd quarter worth about $35,000. Invesco Ltd. increased its stake in Alta Equipment Group by 7.4% in the 1st quarter. Invesco Ltd. now owns 84,363 shares of the company's stock worth $396,000 after buying an additional 5,781 shares during the period. Finally, Bank of America Corp DE grew its holdings in Alta Equipment Group by 4.1% during the 2nd quarter. Bank of America Corp DE now owns 170,161 shares of the company's stock worth $1,075,000 after acquiring an additional 6,698 shares in the last quarter. Hedge funds and other institutional investors own 73.58% of the company's stock.

Alta Equipment Group Stock Performance

ALTG opened at $6.36 on Friday. The firm has a market cap of $203.84 million, a P/E ratio of -3.09 and a beta of 1.58. Alta Equipment Group has a 1-year low of $3.54 and a 1-year high of $8.99. The company has a 50 day simple moving average of $7.60 and a two-hundred day simple moving average of $6.35. The company has a debt-to-equity ratio of 16.69, a current ratio of 1.39 and a quick ratio of 0.48.

Alta Equipment Group (NYSE:ALTG - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported ($0.21) EPS for the quarter, beating the consensus estimate of ($0.27) by $0.06. Alta Equipment Group had a negative net margin of 3.53% and a negative return on equity of 95.61%. The business had revenue of $481.20 million during the quarter, compared to analyst estimates of $478.63 million. Equities analysts forecast that Alta Equipment Group will post -1.92 earnings per share for the current fiscal year.

Alta Equipment Group Company Profile

(

Get Free Report)

Alta Equipment Group Inc owns and operates integrated equipment dealership platforms in the United States. It operates through three segments: Material Handling, Construction Equipment, and Master Distribution. The company operates a branch network that sells, rents, and provides parts and service support for various categories of specialized equipment, including lift trucks and other material handling equipment, heavy and compact earthmoving equipment, crushing and screening equipment, environmental processing equipment, cranes and aerial work platforms, paving and asphalt equipment, and other construction equipment and related products.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alta Equipment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alta Equipment Group wasn't on the list.

While Alta Equipment Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.