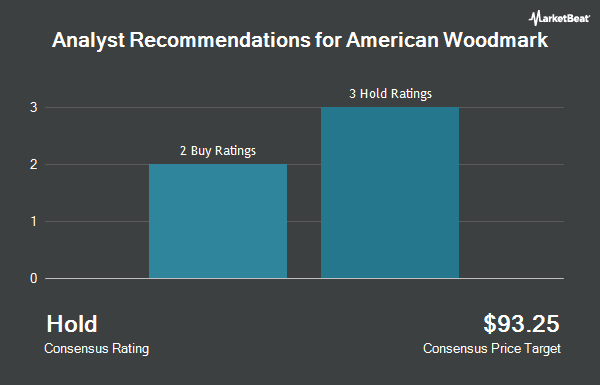

American Woodmark Corporation (NASDAQ:AMWD - Get Free Report) has been assigned an average recommendation of "Hold" from the five ratings firms that are currently covering the firm, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell rating, two have given a hold rating and two have assigned a buy rating to the company. The average 1-year price objective among analysts that have issued a report on the stock in the last year is $70.00.

A number of research firms have issued reports on AMWD. Weiss Ratings restated a "hold (c)" rating on shares of American Woodmark in a report on Saturday, September 27th. Robert W. Baird upped their price objective on shares of American Woodmark from $64.00 to $68.00 and gave the company an "outperform" rating in a research report on Thursday, August 28th.

Get Our Latest Analysis on AMWD

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in AMWD. Public Employees Retirement System of Ohio acquired a new position in shares of American Woodmark during the fourth quarter valued at about $43,000. GAMMA Investing LLC raised its position in American Woodmark by 32.9% in the first quarter. GAMMA Investing LLC now owns 795 shares of the company's stock worth $47,000 after purchasing an additional 197 shares in the last quarter. Canada Pension Plan Investment Board acquired a new position in American Woodmark in the second quarter worth about $64,000. CWM LLC raised its position in American Woodmark by 116.0% in the second quarter. CWM LLC now owns 1,296 shares of the company's stock worth $69,000 after purchasing an additional 696 shares in the last quarter. Finally, Farther Finance Advisors LLC raised its position in American Woodmark by 34,380.0% in the second quarter. Farther Finance Advisors LLC now owns 1,724 shares of the company's stock worth $92,000 after purchasing an additional 1,719 shares in the last quarter. Institutional investors and hedge funds own 95.47% of the company's stock.

American Woodmark Stock Performance

AMWD stock traded down $0.36 during mid-day trading on Friday, reaching $67.55. 163,942 shares of the stock traded hands, compared to its average volume of 208,899. The company has a quick ratio of 1.05, a current ratio of 2.04 and a debt-to-equity ratio of 0.40. American Woodmark has a 52 week low of $50.00 and a 52 week high of $104.28. The business has a 50-day moving average of $64.02 and a two-hundred day moving average of $59.11. The firm has a market capitalization of $984.20 million, a PE ratio of 12.08 and a beta of 1.19.

American Woodmark (NASDAQ:AMWD - Get Free Report) last released its quarterly earnings results on Tuesday, August 26th. The company reported $1.01 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.14 by ($0.13). American Woodmark had a net margin of 5.11% and a return on equity of 9.43%. The firm had revenue of $403.05 million for the quarter, compared to the consensus estimate of $420.64 million. During the same quarter last year, the company earned $1.89 earnings per share. The firm's revenue was down 12.2% on a year-over-year basis.

American Woodmark Company Profile

(

Get Free Report)

American Woodmark Corporation manufactures and distributes kitchen, bath, office, home organization, and hardware products for the remodelling and new home construction markets in the United States. The company offers made-to-order and cash and carry products. It also provides turnkey installation services to its direct builder customers through a network of eight service centers.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider American Woodmark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Woodmark wasn't on the list.

While American Woodmark currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.