Amphenol (NYSE:APH - Free Report) had its price objective raised by Bank of America from $110.00 to $120.00 in a research report report published on Tuesday,Benzinga reports. The brokerage currently has a neutral rating on the electronics maker's stock.

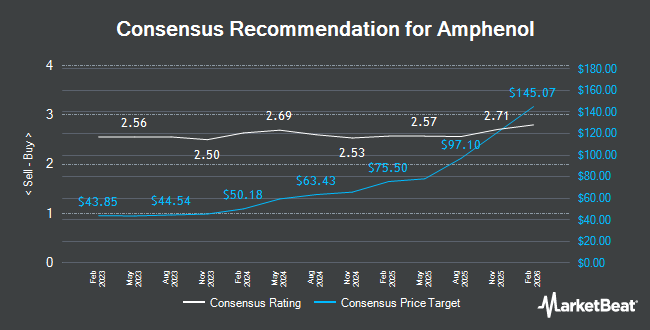

Several other equities research analysts also recently issued reports on APH. Wall Street Zen raised Amphenol from a "buy" rating to a "strong-buy" rating in a research note on Saturday, August 2nd. TD Securities increased their price objective on Amphenol from $63.00 to $70.00 and gave the stock a "hold" rating in a research note on Thursday, May 1st. JPMorgan Chase & Co. increased their price objective on Amphenol from $120.00 to $125.00 and gave the stock an "overweight" rating in a research note on Thursday, July 24th. KGI Securities began coverage on Amphenol in a research note on Thursday, June 26th. They issued a "hold" rating for the company. Finally, Industrial Alliance Securities set a $115.00 price objective on Amphenol in a research note on Friday, July 11th. Four investment analysts have rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $104.92.

View Our Latest Research Report on APH

Amphenol Trading Up 1.3%

Shares of NYSE APH traded up $1.46 during mid-day trading on Tuesday, hitting $110.01. 5,052,387 shares of the company traded hands, compared to its average volume of 9,351,925. Amphenol has a 1 year low of $56.45 and a 1 year high of $110.60. The stock has a market capitalization of $134.31 billion, a price-to-earnings ratio of 43.83, a PEG ratio of 1.79 and a beta of 1.13. The company has a quick ratio of 1.46, a current ratio of 2.02 and a debt-to-equity ratio of 0.61. The business has a 50 day moving average of $99.07 and a two-hundred day moving average of $80.97.

Amphenol (NYSE:APH - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The electronics maker reported $0.81 EPS for the quarter, beating the consensus estimate of $0.66 by $0.15. The business had revenue of $5.65 billion during the quarter, compared to the consensus estimate of $5.01 billion. Amphenol had a return on equity of 30.58% and a net margin of 16.90%. Amphenol's revenue was up 56.5% compared to the same quarter last year. During the same period in the prior year, the business posted $0.44 earnings per share. On average, sell-side analysts anticipate that Amphenol will post 2.36 earnings per share for the current fiscal year.

Amphenol Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 8th. Stockholders of record on Tuesday, September 16th will be issued a dividend of $0.165 per share. The ex-dividend date of this dividend is Tuesday, September 16th. This represents a $0.66 dividend on an annualized basis and a dividend yield of 0.6%. Amphenol's dividend payout ratio is currently 26.29%.

Insider Buying and Selling

In other news, VP David M. Silverman sold 100,000 shares of the stock in a transaction dated Friday, May 30th. The stock was sold at an average price of $89.09, for a total transaction of $8,909,000.00. Following the transaction, the vice president owned 12,500 shares of the company's stock, valued at approximately $1,113,625. This represents a 88.89% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, insider William J. Doherty sold 160,000 shares of the stock in a transaction dated Friday, May 30th. The shares were sold at an average price of $89.54, for a total value of $14,326,400.00. The disclosure for this sale can be found here. In the last quarter, insiders sold 586,000 shares of company stock worth $52,935,980. Insiders own 1.67% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the stock. Opal Wealth Advisors LLC acquired a new stake in Amphenol in the 2nd quarter valued at approximately $25,000. Hilltop National Bank acquired a new stake in Amphenol in the 2nd quarter valued at approximately $35,000. Hughes Financial Services LLC acquired a new stake in Amphenol in the 1st quarter valued at approximately $25,000. Avalon Trust Co grew its holdings in Amphenol by 133.3% in the 1st quarter. Avalon Trust Co now owns 406 shares of the electronics maker's stock valued at $27,000 after buying an additional 232 shares during the last quarter. Finally, N.E.W. Advisory Services LLC acquired a new stake in Amphenol in the 1st quarter valued at approximately $28,000. Institutional investors and hedge funds own 97.01% of the company's stock.

About Amphenol

(

Get Free Report)

Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally. It operates through three segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

Recommended Stories

Before you consider Amphenol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphenol wasn't on the list.

While Amphenol currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.