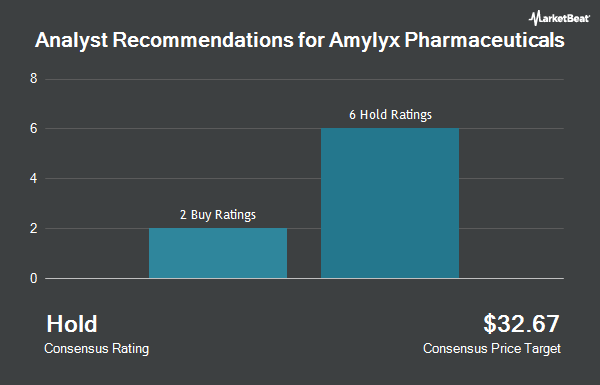

Shares of Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX - Get Free Report) have received an average recommendation of "Buy" from the thirteen research firms that are presently covering the company, Marketbeat Ratings reports. Two research analysts have rated the stock with a hold rating, nine have assigned a buy rating and two have assigned a strong buy rating to the company. The average 12-month target price among analysts that have issued a report on the stock in the last year is $11.75.

A number of analysts recently commented on AMLX shares. Wall Street Zen upgraded shares of Amylyx Pharmaceuticals from a "sell" rating to a "hold" rating in a research report on Friday, July 18th. UBS Group raised Amylyx Pharmaceuticals to a "hold" rating in a research note on Tuesday, June 24th. Jefferies Financial Group assumed coverage on Amylyx Pharmaceuticals in a research report on Tuesday, June 24th. They set a "hold" rating on the stock. Guggenheim initiated coverage on Amylyx Pharmaceuticals in a research report on Tuesday, June 24th. They issued a "buy" rating and a $17.00 price objective for the company. Finally, Leerink Partners raised Amylyx Pharmaceuticals from a "market perform" rating to an "outperform" rating and increased their target price for the stock from $4.00 to $10.00 in a research note on Wednesday, May 7th.

Get Our Latest Analysis on Amylyx Pharmaceuticals

Amylyx Pharmaceuticals Stock Performance

AMLX traded down $0.02 during midday trading on Friday, reaching $8.16. 352,872 shares of the company were exchanged, compared to its average volume of 1,109,920. The stock has a market capitalization of $727.38 million, a P/E ratio of -2.62 and a beta of -0.46. Amylyx Pharmaceuticals has a one year low of $1.76 and a one year high of $8.72. The stock's 50-day simple moving average is $6.62 and its 200 day simple moving average is $4.89.

Amylyx Pharmaceuticals (NASDAQ:AMLX - Get Free Report) last released its quarterly earnings data on Thursday, May 8th. The company reported ($0.42) earnings per share for the quarter, topping the consensus estimate of ($0.45) by $0.03. On average, research analysts anticipate that Amylyx Pharmaceuticals will post -2.2 earnings per share for the current year.

Institutional Investors Weigh In On Amylyx Pharmaceuticals

Several hedge funds and other institutional investors have recently added to or reduced their stakes in AMLX. Adage Capital Partners GP L.L.C. bought a new position in shares of Amylyx Pharmaceuticals in the 1st quarter valued at about $20,170,000. Millennium Management LLC grew its stake in Amylyx Pharmaceuticals by 418.6% in the first quarter. Millennium Management LLC now owns 3,081,853 shares of the company's stock valued at $10,910,000 after purchasing an additional 2,487,617 shares in the last quarter. Boxer Capital Management LLC acquired a new position in shares of Amylyx Pharmaceuticals during the 4th quarter worth approximately $6,615,000. Woodline Partners LP bought a new stake in shares of Amylyx Pharmaceuticals during the 1st quarter worth approximately $5,697,000. Finally, Bank of America Corp DE raised its stake in shares of Amylyx Pharmaceuticals by 165.9% during the 4th quarter. Bank of America Corp DE now owns 2,426,263 shares of the company's stock worth $9,171,000 after purchasing an additional 1,513,748 shares in the last quarter. 95.84% of the stock is currently owned by institutional investors and hedge funds.

Amylyx Pharmaceuticals Company Profile

(

Get Free Report)

Amylyx Pharmaceuticals, Inc, a commercial-stage biotechnology company, engages in the discovery and development of treatment for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases. The company's products include RELYVRIO, a dual UPR-Bax apoptosis inhibitor composed of sodium phenylbutyrate and taurursodiol for the treatment of ALS in adults in the United States and marketed as ALBRIOZA for the treatment of ALS in Canada.

Featured Articles

Before you consider Amylyx Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amylyx Pharmaceuticals wasn't on the list.

While Amylyx Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.