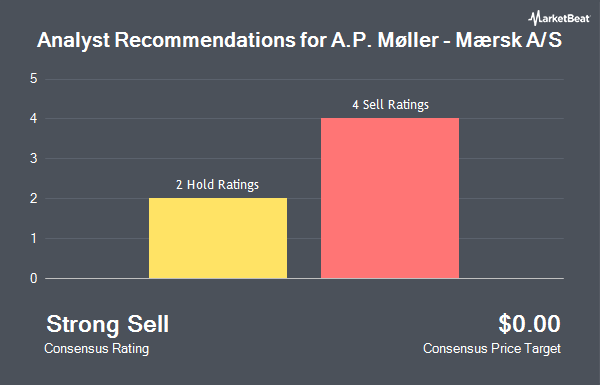

Shares of A.P. Moller-Maersk (OTCMKTS:AMKBY - Get Free Report) have received an average recommendation of "Strong Sell" from the seven analysts that are covering the stock, Marketbeat.com reports. Five investment analysts have rated the stock with a sell recommendation and two have given a hold recommendation to the company.

Several research analysts have recently issued reports on the company. Morgan Stanley reissued an "underweight" rating on shares of A.P. Moller-Maersk in a research note on Friday, August 8th. Citigroup reissued a "neutral" rating on shares of A.P. Moller-Maersk in a research note on Friday, August 8th. BNP Paribas Exane cut A.P. Moller-Maersk from a "neutral" rating to an "underperform" rating in a research note on Wednesday, September 17th. Finally, BNP Paribas cut A.P. Moller-Maersk to a "strong sell" rating in a research note on Wednesday, September 17th.

Get Our Latest Analysis on A.P. Moller-Maersk

A.P. Moller-Maersk Price Performance

AMKBY stock opened at $10.00 on Friday. The company has a quick ratio of 1.96, a current ratio of 2.06 and a debt-to-equity ratio of 0.07. A.P. Moller-Maersk has a 52-week low of $6.69 and a 52-week high of $11.50. The stock's 50 day moving average is $10.49 and its two-hundred day moving average is $9.44. The company has a market capitalization of $31.66 billion, a PE ratio of 4.57 and a beta of 1.01.

A.P. Moller-Maersk (OTCMKTS:AMKBY - Get Free Report) last issued its earnings results on Thursday, August 7th. The transportation company reported $0.20 earnings per share for the quarter, topping the consensus estimate of $0.14 by $0.06. A.P. Moller-Maersk had a return on equity of 12.33% and a net margin of 12.11%.The firm had revenue of $13.13 billion for the quarter, compared to analyst estimates of $12.34 billion. Analysts predict that A.P. Moller-Maersk will post 0.41 earnings per share for the current fiscal year.

About A.P. Moller-Maersk

(

Get Free Report)

A.P. Møller - Mærsk A/S, together with its subsidiaries, engages in the ocean transport and logistics business in Denmark and internationally. It operates through Ocean, Logistics & Services, Terminals, and Towage & Maritime Services segments. The Ocean segment is involved in container shipping activities, including demurrage and detention, terminal handling, documentation and container services, and container storage, as well as transshipment hubs.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider A.P. Moller-Maersk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A.P. Moller-Maersk wasn't on the list.

While A.P. Moller-Maersk currently has a Strong Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.