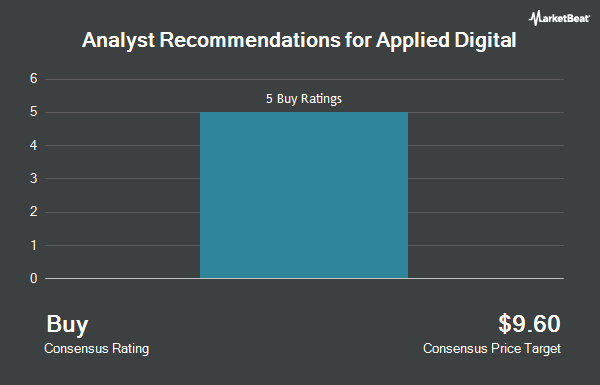

Shares of Applied Digital Corporation (NASDAQ:APLD - Get Free Report) have received a consensus rating of "Buy" from the thirteen analysts that are covering the company, MarketBeat.com reports. One analyst has rated the stock with a hold rating, eleven have issued a buy rating and one has issued a strong buy rating on the company. The average 1-year price objective among brokers that have issued a report on the stock in the last year is $12.73.

Several analysts have commented on APLD shares. Compass Point reaffirmed a "neutral" rating and issued a $13.00 price objective (up previously from $10.00) on shares of Applied Digital in a research report on Monday, June 9th. B. Riley raised their target price on Applied Digital from $8.00 to $15.00 and gave the stock a "buy" rating in a research report on Wednesday, June 4th. Roth Capital reissued a "buy" rating on shares of Applied Digital in a report on Monday, June 2nd. Craig Hallum increased their target price on Applied Digital from $10.00 to $12.00 and gave the stock a "buy" rating in a research report on Tuesday, June 3rd. Finally, Needham & Company LLC reiterated a "buy" rating and set a $10.00 price objective on shares of Applied Digital in a research note on Monday, June 2nd.

Get Our Latest Report on APLD

Applied Digital Stock Down 1.1%

Applied Digital stock traded down $0.12 during trading on Tuesday, hitting $10.49. 30,640,594 shares of the company were exchanged, compared to its average volume of 39,364,367. The company has a market capitalization of $2.36 billion, a P/E ratio of -7.66 and a beta of 6.08. The business's 50 day moving average is $7.28 and its 200 day moving average is $7.67. Applied Digital has a 52 week low of $3.01 and a 52 week high of $15.42. The company has a current ratio of 0.70, a quick ratio of 0.70 and a debt-to-equity ratio of 1.56.

Applied Digital (NASDAQ:APLD - Get Free Report) last issued its quarterly earnings data on Monday, April 14th. The company reported ($0.16) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.11) by ($0.05). Applied Digital had a negative return on equity of 77.49% and a negative net margin of 109.99%. The firm had revenue of $52.92 million during the quarter, compared to the consensus estimate of $62.91 million. During the same period in the previous year, the company posted ($0.24) earnings per share. Analysts predict that Applied Digital will post -0.96 earnings per share for the current year.

Insiders Place Their Bets

In related news, Director Rachel H. Lee sold 24,212 shares of the business's stock in a transaction dated Wednesday, May 21st. The stock was sold at an average price of $7.00, for a total transaction of $169,484.00. Following the transaction, the director now owns 83,613 shares in the company, valued at $585,291. The trade was a 22.45% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 11.81% of the company's stock.

Hedge Funds Weigh In On Applied Digital

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Situational Awareness LP purchased a new stake in shares of Applied Digital in the 1st quarter worth about $22,680,000. Vanguard Group Inc. raised its position in shares of Applied Digital by 39.1% in the 4th quarter. Vanguard Group Inc. now owns 12,760,035 shares of the company's stock worth $97,487,000 after purchasing an additional 3,587,619 shares during the last quarter. Tidal Investments LLC boosted its stake in Applied Digital by 14,635.7% in the 4th quarter. Tidal Investments LLC now owns 1,697,850 shares of the company's stock worth $12,972,000 after purchasing an additional 1,686,328 shares in the last quarter. American Century Companies Inc. purchased a new stake in Applied Digital during the 4th quarter valued at about $12,843,000. Finally, Geode Capital Management LLC increased its stake in Applied Digital by 54.4% during the 4th quarter. Geode Capital Management LLC now owns 4,726,495 shares of the company's stock valued at $36,117,000 after purchasing an additional 1,665,335 shares in the last quarter. Hedge funds and other institutional investors own 65.67% of the company's stock.

Applied Digital Company Profile

(

Get Free ReportApplied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

Recommended Stories

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.