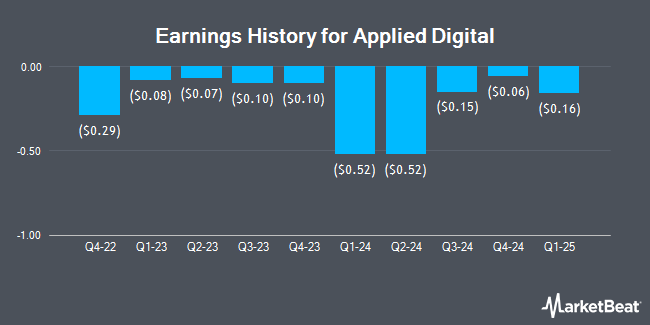

Applied Digital (NASDAQ:APLD - Get Free Report) announced its earnings results on Wednesday. The company reported ($0.12) EPS for the quarter, meeting analysts' consensus estimates of ($0.12), Zacks reports. Applied Digital had a negative net margin of 107.22% and a negative return on equity of 50.03%. The business had revenue of $38.01 million during the quarter, compared to analysts' expectations of $42.86 million. During the same period in the prior year, the company earned ($0.14) earnings per share. The firm's revenue was up 41.3% on a year-over-year basis.

Applied Digital Price Performance

APLD stock traded up $0.62 during trading on Monday, hitting $13.14. 7,985,216 shares of the company's stock traded hands, compared to its average volume of 38,423,359. Applied Digital has a 52 week low of $3.01 and a 52 week high of $15.42. The stock has a market capitalization of $3.44 billion, a price-to-earnings ratio of -12.06 and a beta of 6.17. The business has a fifty day simple moving average of $10.49 and a 200 day simple moving average of $8.00. The company has a debt-to-equity ratio of 1.36, a quick ratio of 0.77 and a current ratio of 0.77.

Insider Activity at Applied Digital

In other Applied Digital news, Director Rachel H. Lee sold 24,212 shares of Applied Digital stock in a transaction on Wednesday, May 21st. The shares were sold at an average price of $7.00, for a total value of $169,484.00. Following the completion of the transaction, the director directly owned 83,613 shares of the company's stock, valued at $585,291. This trade represents a 22.45% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. 11.81% of the stock is owned by insiders.

Hedge Funds Weigh In On Applied Digital

A number of institutional investors and hedge funds have recently made changes to their positions in APLD. Geneos Wealth Management Inc. grew its stake in shares of Applied Digital by 113.3% in the 1st quarter. Geneos Wealth Management Inc. now owns 6,667 shares of the company's stock worth $37,000 after buying an additional 3,542 shares in the last quarter. Strs Ohio purchased a new position in shares of Applied Digital in the 1st quarter worth $71,000. AQR Capital Management LLC grew its stake in shares of Applied Digital by 84.8% in the 1st quarter. AQR Capital Management LLC now owns 18,945 shares of the company's stock worth $106,000 after buying an additional 8,692 shares in the last quarter. Finally, NewEdge Advisors LLC lifted its holdings in shares of Applied Digital by 239.1% in the 1st quarter. NewEdge Advisors LLC now owns 33,267 shares of the company's stock worth $187,000 after acquiring an additional 23,457 shares during the last quarter. 65.67% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of analysts have recently issued reports on the stock. Citigroup reissued an "outperform" rating on shares of Applied Digital in a research note on Tuesday, June 3rd. Craig Hallum increased their price objective on shares of Applied Digital from $10.00 to $12.00 and gave the stock a "buy" rating in a research note on Tuesday, June 3rd. Needham & Company LLC increased their price objective on shares of Applied Digital from $12.00 to $16.00 and gave the stock a "buy" rating in a research note on Thursday. Lake Street Capital increased their price objective on shares of Applied Digital from $14.00 to $18.00 and gave the stock a "buy" rating in a research note on Thursday. Finally, JMP Securities increased their price objective on shares of Applied Digital from $12.00 to $18.00 and gave the stock a "market outperform" rating in a research note on Tuesday, June 3rd. Twelve analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Applied Digital has an average rating of "Buy" and a consensus target price of $14.18.

Check Out Our Latest Stock Report on Applied Digital

About Applied Digital

(

Get Free Report)

Applied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

Further Reading

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.