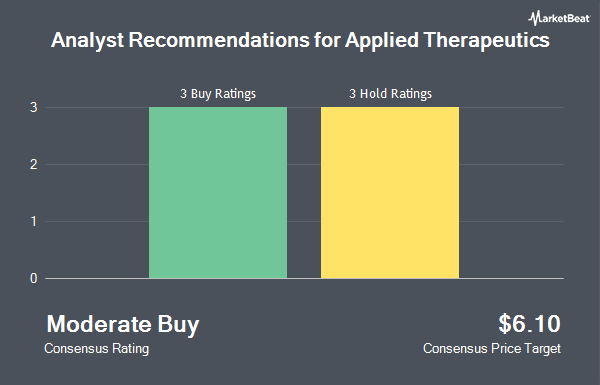

Shares of Applied Therapeutics Inc. (NASDAQ:APLT - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the six research firms that are currently covering the firm, MarketBeat reports. Three research analysts have rated the stock with a hold recommendation and three have issued a buy recommendation on the company. The average twelve-month target price among analysts that have updated their coverage on the stock in the last year is $6.10.

Several equities research analysts have recently weighed in on APLT shares. Royal Bank Of Canada reissued a "sector perform" rating and issued a $1.50 target price on shares of Applied Therapeutics in a research note on Wednesday, May 14th. Wall Street Zen raised shares of Applied Therapeutics to a "sell" rating in a research note on Saturday, July 26th.

View Our Latest Research Report on APLT

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the stock. Ground Swell Capital LLC purchased a new position in Applied Therapeutics in the 4th quarter worth about $27,000. Toronto Dominion Bank bought a new position in Applied Therapeutics during the 4th quarter worth about $27,000. CreativeOne Wealth LLC grew its holdings in Applied Therapeutics by 132.2% during the 1st quarter. CreativeOne Wealth LLC now owns 50,413 shares of the company's stock worth $25,000 after acquiring an additional 28,701 shares in the last quarter. Dark Forest Capital Management LP grew its holdings in Applied Therapeutics by 54.5% during the 4th quarter. Dark Forest Capital Management LP now owns 53,718 shares of the company's stock worth $46,000 after acquiring an additional 18,949 shares in the last quarter. Finally, Tudor Investment Corp ET AL bought a new position in Applied Therapeutics during the 4th quarter worth about $49,000. Hedge funds and other institutional investors own 98.31% of the company's stock.

Applied Therapeutics Stock Up 2.9%

APLT stock opened at $0.5141 on Friday. Applied Therapeutics has a 52 week low of $0.2950 and a 52 week high of $10.6237. The company has a fifty day simple moving average of $0.42 and a two-hundred day simple moving average of $0.44. The firm has a market capitalization of $74.04 million, a P/E ratio of -1.14 and a beta of 1.97.

Applied Therapeutics (NASDAQ:APLT - Get Free Report) last released its quarterly earnings data on Wednesday, August 13th. The company reported ($0.15) EPS for the quarter, beating the consensus estimate of ($0.17) by $0.02. As a group, analysts anticipate that Applied Therapeutics will post -0.65 EPS for the current year.

About Applied Therapeutics

(

Get Free Report)

Applied Therapeutics, Inc, a clinical-stage biopharmaceutical company, engages in the development of a pipeline of novel product candidates against validated molecular targets in indications of high unmet medical need in the United States. The company's lead product candidate is AT-007 (also called govorestat) that has completed phase 3 for the treatment of galactosemia in healthy volunteers and adults, in pediatric clinical study for the treatment of galactosemia in kids, for treating enzyme sorbitol dehydrogenase, and for the treatment of phosphomannomutase enzyme-CDG.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Applied Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Therapeutics wasn't on the list.

While Applied Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.