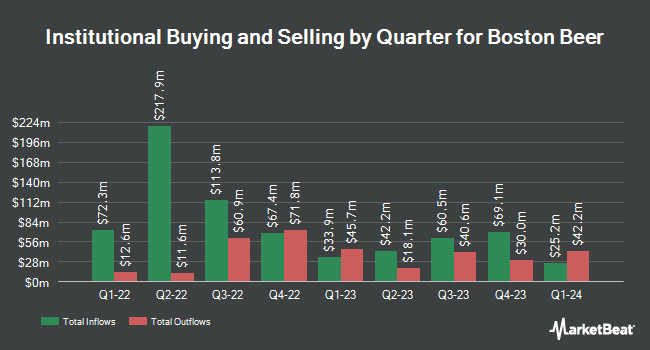

AQR Capital Management LLC lifted its position in shares of The Boston Beer Company, Inc. (NYSE:SAM - Free Report) by 19.8% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 422,217 shares of the company's stock after purchasing an additional 69,778 shares during the quarter. AQR Capital Management LLC owned 3.68% of Boston Beer worth $125,821,000 at the end of the most recent reporting period.

A number of other large investors also recently modified their holdings of SAM. Norges Bank acquired a new position in Boston Beer during the fourth quarter worth $30,741,000. Cooper Creek Partners Management LLC acquired a new stake in shares of Boston Beer in the 4th quarter worth about $25,054,000. Global Alpha Capital Management Ltd. acquired a new stake in shares of Boston Beer in the 4th quarter worth about $23,349,000. Fisher Asset Management LLC lifted its position in Boston Beer by 27.1% in the 4th quarter. Fisher Asset Management LLC now owns 160,419 shares of the company's stock valued at $48,122,000 after acquiring an additional 34,176 shares in the last quarter. Finally, T. Rowe Price Investment Management Inc. boosted its stake in Boston Beer by 4.4% during the 4th quarter. T. Rowe Price Investment Management Inc. now owns 703,480 shares of the company's stock valued at $211,030,000 after purchasing an additional 29,412 shares during the last quarter. 81.13% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of research analysts have recently weighed in on the company. Morgan Stanley dropped their target price on Boston Beer from $290.00 to $270.00 and set an "equal weight" rating on the stock in a report on Wednesday, February 26th. StockNews.com upgraded Boston Beer from a "hold" rating to a "buy" rating in a research note on Friday, April 25th. Needham & Company LLC reiterated a "hold" rating on shares of Boston Beer in a research note on Friday, April 25th. Berenberg Bank initiated coverage on shares of Boston Beer in a research report on Wednesday, April 2nd. They set a "hold" rating and a $281.10 price target on the stock. Finally, Roth Mkm restated a "buy" rating and set a $349.00 price target (down from $389.00) on shares of Boston Beer in a report on Wednesday, February 26th. Eight analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $286.12.

Get Our Latest Report on SAM

Boston Beer Price Performance

Shares of Boston Beer stock traded up $5.30 on Monday, reaching $244.86. 25,678 shares of the company traded hands, compared to its average volume of 170,580. The firm has a market capitalization of $2.75 billion, a PE ratio of 36.02, a PEG ratio of 1.23 and a beta of 1.26. The company has a 50 day moving average of $238.15 and a 200 day moving average of $267.45. The Boston Beer Company, Inc. has a 52 week low of $215.10 and a 52 week high of $339.77.

Boston Beer (NYSE:SAM - Get Free Report) last posted its earnings results on Thursday, April 24th. The company reported $2.16 earnings per share for the quarter, topping the consensus estimate of $0.78 by $1.38. The firm had revenue of $481.36 million during the quarter, compared to the consensus estimate of $436.27 million. Boston Beer had a net margin of 3.82% and a return on equity of 11.76%. The company's revenue was up 6.5% on a year-over-year basis. During the same quarter last year, the company earned $1.04 earnings per share. As a group, analysts anticipate that The Boston Beer Company, Inc. will post 9.29 earnings per share for the current year.

Boston Beer Company Profile

(

Free Report)

The Boston Beer Company, Inc produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, flavored malt beverages, and hard seltzers under the Samuel Adams, Twisted Tea, Truly, Angry Orchard, Dogfish Head, Angel City, and Coney Island brand names.

See Also

Before you consider Boston Beer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Beer wasn't on the list.

While Boston Beer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.