Aquestive Therapeutics (NASDAQ:AQST - Get Free Report)'s stock had its "sell (d-)" rating reissued by equities research analysts at Weiss Ratings in a research report issued on Friday,Weiss Ratings reports.

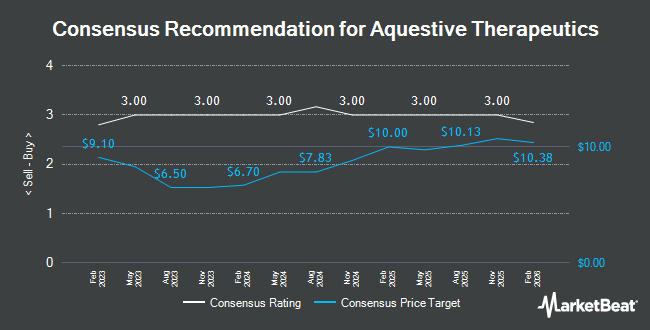

A number of other research firms have also recently issued reports on AQST. JMP Securities upped their price target on shares of Aquestive Therapeutics from $9.00 to $12.00 and gave the company a "market outperform" rating in a report on Thursday, October 9th. Oppenheimer upped their price target on shares of Aquestive Therapeutics from $7.00 to $8.00 and gave the company an "outperform" rating in a report on Monday, September 8th. Zacks Research upgraded shares of Aquestive Therapeutics from a "hold" rating to a "strong-buy" rating in a report on Friday, October 17th. Citigroup restated an "outperform" rating on shares of Aquestive Therapeutics in a report on Thursday, October 9th. Finally, Lifesci Capital upgraded shares of Aquestive Therapeutics to a "strong-buy" rating in a report on Wednesday, September 3rd. Two research analysts have rated the stock with a Strong Buy rating, eight have issued a Buy rating and one has given a Sell rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $10.71.

Get Our Latest Stock Analysis on Aquestive Therapeutics

Aquestive Therapeutics Stock Down 2.4%

AQST stock traded down $0.17 during mid-day trading on Friday, reaching $6.84. 2,409,424 shares of the stock traded hands, compared to its average volume of 1,932,509. Aquestive Therapeutics has a 52 week low of $2.12 and a 52 week high of $7.55. The business has a 50-day moving average of $5.32 and a two-hundred day moving average of $3.95. The firm has a market capitalization of $682.08 million, a PE ratio of -9.77 and a beta of 1.77.

Aquestive Therapeutics (NASDAQ:AQST - Get Free Report) last released its quarterly earnings results on Monday, August 11th. The company reported ($0.14) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.18) by $0.04. The firm had revenue of $10.00 million for the quarter, compared to the consensus estimate of $11.32 million. Aquestive Therapeutics has set its FY 2025 guidance at EPS. On average, equities research analysts anticipate that Aquestive Therapeutics will post -0.46 EPS for the current fiscal year.

Insider Buying and Selling at Aquestive Therapeutics

In related news, CEO Daniel Barber sold 91,343 shares of the stock in a transaction dated Friday, September 26th. The shares were sold at an average price of $6.03, for a total value of $550,798.29. Following the completion of the transaction, the chief executive officer owned 923,430 shares of the company's stock, valued at $5,568,282.90. This represents a 9.00% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, COO Cassie Jung sold 67,575 shares of the stock in a transaction dated Wednesday, October 15th. The stock was sold at an average price of $7.01, for a total transaction of $473,700.75. Following the completion of the transaction, the chief operating officer directly owned 240,771 shares of the company's stock, valued at $1,687,804.71. This trade represents a 21.92% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 276,770 shares of company stock worth $1,692,203. 8.35% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Several hedge funds have recently added to or reduced their stakes in the business. Daymark Wealth Partners LLC raised its position in Aquestive Therapeutics by 44.4% in the third quarter. Daymark Wealth Partners LLC now owns 25,278 shares of the company's stock worth $141,000 after purchasing an additional 7,778 shares in the last quarter. Commonwealth Equity Services LLC acquired a new stake in shares of Aquestive Therapeutics during the third quarter worth approximately $5,918,000. Trust Point Inc. acquired a new stake in shares of Aquestive Therapeutics during the third quarter worth approximately $126,000. Cox Capital Mgt LLC acquired a new stake in shares of Aquestive Therapeutics during the third quarter worth approximately $59,000. Finally, Modern Wealth Management LLC acquired a new stake in shares of Aquestive Therapeutics during the second quarter worth approximately $33,000. Institutional investors and hedge funds own 32.45% of the company's stock.

Aquestive Therapeutics Company Profile

(

Get Free Report)

Aquestive Therapeutics, Inc operates as a pharmaceutical company in the United States and internationally. The company markets Sympazan, an oral soluble film formulation of clobazam for the treatment of lennox-gastaut syndrome; Suboxone, a sublingual film formulation of buprenorphine and naloxone for the treatment of opioid dependence; Zuplenz, an oral soluble film formulation of ondansetron for the treatment of nausea and vomiting associated with chemotherapy and post-operative recovery; and Azstarys, a once-daily product for the treatment of attention deficit hyperactivity disorder.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Aquestive Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aquestive Therapeutics wasn't on the list.

While Aquestive Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.