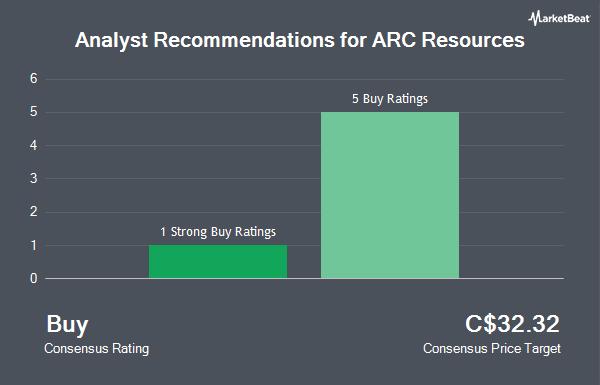

ARC Resources Ltd. (TSE:ARX - Get Free Report) has been assigned an average recommendation of "Buy" from the eight analysts that are presently covering the stock, Marketbeat Ratings reports. Eight research analysts have rated the stock with a buy rating. The average 1-year price objective among brokers that have issued a report on the stock in the last year is C$33.33.

A number of equities analysts have issued reports on the stock. BMO Capital Markets raised their price objective on shares of ARC Resources from C$32.00 to C$33.00 and gave the company an "outperform" rating in a research note on Thursday, July 3rd. Raymond James Financial reduced their price objective on shares of ARC Resources from C$35.00 to C$33.00 and set an "outperform" rating on the stock in a research note on Monday, September 15th.

Check Out Our Latest Research Report on ARC Resources

ARC Resources Price Performance

ARX opened at C$26.01 on Monday. ARC Resources has a one year low of C$21.68 and a one year high of C$31.56. The stock has a market capitalization of C$15.13 billion, a P/E ratio of 10.28, a price-to-earnings-growth ratio of 0.29 and a beta of 0.29. The company has a debt-to-equity ratio of 30.05, a current ratio of 1.14 and a quick ratio of 0.42. The company's 50 day simple moving average is C$26.32 and its 200-day simple moving average is C$27.36.

ARC Resources Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 15th. Shareholders of record on Monday, September 29th will be paid a $0.19 dividend. This represents a $0.76 dividend on an annualized basis and a yield of 2.9%. ARC Resources's payout ratio is presently 29.25%.

ARC Resources Company Profile

(

Get Free Report)

ARC Resources is an independent energy company engaged in the acquisition, exploration, development, and production of conventional oil and natural gas in Western Canada. The company produces light, medium, and heavy crude, condensate, natural gas liquids, and natural gas. Production averaged 163.6 thousand barrels of oil equivalent per day in 2020, and the company estimates that it holds approximately 879 million boe of proven and probable crude oil and natural gas reserves.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ARC Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ARC Resources wasn't on the list.

While ARC Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.