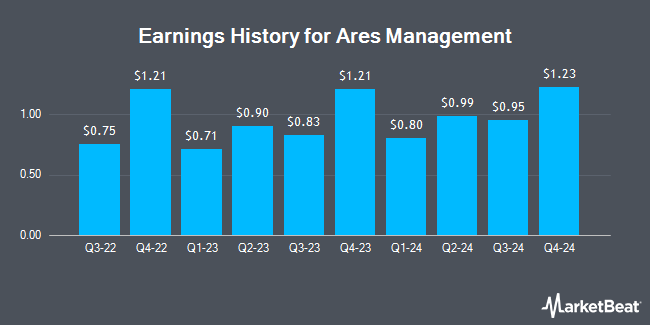

Ares Management (NYSE:ARES - Get Free Report) issued its earnings results on Friday. The asset manager reported $1.03 earnings per share for the quarter, missing the consensus estimate of $1.15 by ($0.12), Zacks reports. Ares Management had a return on equity of 16.29% and a net margin of 9.73%. The business had revenue of $1.35 billion for the quarter, compared to analyst estimates of $1.02 billion. During the same period last year, the business posted $0.99 EPS.

Ares Management Stock Down 2.0%

Shares of NYSE ARES traded down $3.77 on Friday, hitting $181.77. The company had a trading volume of 1,404,163 shares, compared to its average volume of 1,659,198. Ares Management has a 12-month low of $110.63 and a 12-month high of $200.49. The business has a 50 day moving average of $173.59 and a two-hundred day moving average of $166.79. The company has a quick ratio of 1.07, a current ratio of 1.07 and a debt-to-equity ratio of 0.61. The firm has a market capitalization of $59.36 billion, a P/E ratio of 106.88, a PEG ratio of 1.54 and a beta of 1.37.

Ares Management Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Tuesday, September 16th will be given a $1.12 dividend. This represents a $4.48 annualized dividend and a dividend yield of 2.5%. Ares Management's payout ratio is 263.53%.

Analyst Upgrades and Downgrades

ARES has been the topic of several research analyst reports. Oppenheimer lowered Ares Management from an "outperform" rating to a "market perform" rating in a research report on Thursday, May 15th. JMP Securities lifted their price target on Ares Management from $185.00 to $195.00 and gave the stock a "market outperform" rating in a research report on Monday, July 14th. Wolfe Research set a $193.00 price target on Ares Management and gave the stock an "outperform" rating in a research report on Tuesday, May 6th. TD Cowen cut their price target on Ares Management from $216.00 to $161.00 and set a "buy" rating on the stock in a research report on Wednesday, April 9th. Finally, Barclays lifted their price target on Ares Management from $182.00 to $200.00 and gave the stock an "overweight" rating in a research report on Thursday, July 10th. One analyst has rated the stock with a sell rating, five have given a hold rating and thirteen have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $177.50.

View Our Latest Report on ARES

Insider Activity at Ares Management

In related news, CEO Michael J. Arougheti sold 182,108 shares of the stock in a transaction dated Friday, May 16th. The stock was sold at an average price of $170.07, for a total value of $30,971,107.56. Following the completion of the transaction, the chief executive officer owned 350,684 shares of the company's stock, valued at approximately $59,640,827.88. This represents a 34.18% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, Chairman Bennett Rosenthal sold 85,000 shares of the stock in a transaction dated Thursday, June 12th. The shares were sold at an average price of $168.79, for a total value of $14,347,150.00. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 873,145 shares of company stock valued at $146,204,353. Insiders own 36.86% of the company's stock.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the business. AQR Capital Management LLC grew its position in shares of Ares Management by 116.7% in the 1st quarter. AQR Capital Management LLC now owns 10,360 shares of the asset manager's stock worth $1,519,000 after acquiring an additional 5,579 shares in the last quarter. Empowered Funds LLC grew its position in shares of Ares Management by 42.7% in the 1st quarter. Empowered Funds LLC now owns 6,197 shares of the asset manager's stock worth $909,000 after acquiring an additional 1,853 shares in the last quarter. Geneos Wealth Management Inc. grew its position in shares of Ares Management by 708.2% in the 1st quarter. Geneos Wealth Management Inc. now owns 493 shares of the asset manager's stock worth $72,000 after acquiring an additional 432 shares in the last quarter. Focus Partners Wealth raised its position in shares of Ares Management by 15.3% during the 1st quarter. Focus Partners Wealth now owns 1,902 shares of the asset manager's stock worth $279,000 after purchasing an additional 252 shares during the period. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of Ares Management by 5.5% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 1,344 shares of the asset manager's stock worth $197,000 after purchasing an additional 70 shares during the period. Hedge funds and other institutional investors own 50.03% of the company's stock.

About Ares Management

(

Get Free Report)

Ares Management Corporation operates as an alternative asset manager in the United States, Europe, and Asia. The company's Tradable Credit Group segment manages various types of investment funds, such as commingled and separately managed accounts for institutional investors, and publicly traded vehicles and sub-advised funds for retail investors in the tradable and non-investment grade corporate credit markets.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ares Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ares Management wasn't on the list.

While Ares Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.