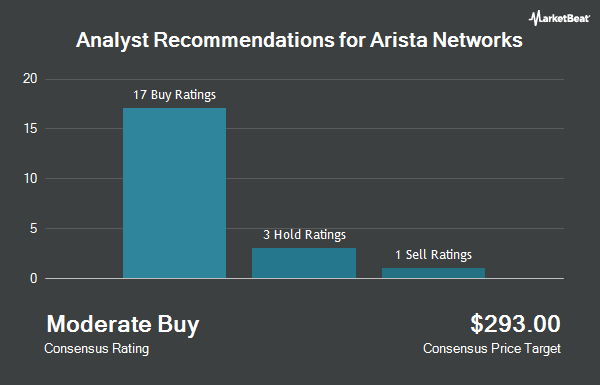

Arista Networks, Inc. (NYSE:ANET - Get Free Report) has been assigned a consensus rating of "Moderate Buy" from the sixteen research firms that are covering the company, MarketBeat.com reports. Four research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company. The average 1-year target price among brokerages that have issued ratings on the stock in the last year is $107.14.

Several equities research analysts have recently weighed in on ANET shares. Evercore ISI lowered their price target on shares of Arista Networks from $130.00 to $100.00 and set an "outperform" rating for the company in a research report on Tuesday, April 15th. JPMorgan Chase & Co. lowered their target price on Arista Networks from $140.00 to $110.00 and set an "overweight" rating for the company in a report on Thursday, April 17th. Citigroup increased their target price on Arista Networks from $97.00 to $112.00 and gave the company a "buy" rating in a research report on Tuesday, May 13th. Rosenblatt Securities boosted their price target on Arista Networks from $85.00 to $87.00 and gave the stock a "neutral" rating in a research report on Wednesday, May 7th. Finally, Erste Group Bank downgraded Arista Networks from a "strong-buy" rating to a "hold" rating in a research report on Monday, March 17th.

Get Our Latest Research Report on Arista Networks

Insider Activity at Arista Networks

In other news, Director Kelly Bodnar Battles sold 1,492 shares of the stock in a transaction that occurred on Tuesday, April 22nd. The shares were sold at an average price of $68.49, for a total value of $102,187.08. Following the completion of the sale, the director now owns 7,480 shares of the company's stock, valued at $512,305.20. This represents a 16.63% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, insider John F. Mccool sold 17,433 shares of the firm's stock in a transaction that occurred on Monday, February 24th. The stock was sold at an average price of $93.14, for a total transaction of $1,623,709.62. Following the sale, the insider now owns 17,433 shares of the company's stock, valued at $1,623,709.62. This represents a 50.00% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 410,867 shares of company stock valued at $37,056,669. Corporate insiders own 3.39% of the company's stock.

Institutional Inflows and Outflows

A number of large investors have recently added to or reduced their stakes in ANET. Zurich Insurance Group Ltd FI purchased a new stake in shares of Arista Networks in the 1st quarter valued at $15,818,000. Empowered Funds LLC lifted its position in shares of Arista Networks by 11.9% during the first quarter. Empowered Funds LLC now owns 97,201 shares of the technology company's stock worth $7,531,000 after purchasing an additional 10,302 shares in the last quarter. Logan Capital Management Inc. boosted its stake in shares of Arista Networks by 0.5% in the first quarter. Logan Capital Management Inc. now owns 161,152 shares of the technology company's stock valued at $12,486,000 after purchasing an additional 853 shares during the period. MBB Public Markets I LLC acquired a new position in shares of Arista Networks in the first quarter valued at approximately $293,000. Finally, Ascent Group LLC increased its stake in Arista Networks by 26.0% during the 1st quarter. Ascent Group LLC now owns 129,994 shares of the technology company's stock worth $10,072,000 after buying an additional 26,828 shares during the period. 82.47% of the stock is currently owned by institutional investors and hedge funds.

Arista Networks Price Performance

Shares of ANET opened at $96.31 on Friday. The firm has a market capitalization of $120.95 billion, a price-to-earnings ratio of 43.38, a PEG ratio of 3.10 and a beta of 1.38. Arista Networks has a 1-year low of $59.43 and a 1-year high of $133.58. The company has a 50-day moving average of $80.29 and a 200 day moving average of $97.20.

Arista Networks (NYSE:ANET - Get Free Report) last issued its earnings results on Tuesday, May 6th. The technology company reported $0.65 EPS for the quarter, topping analysts' consensus estimates of $0.59 by $0.06. The business had revenue of $2 billion for the quarter, compared to analyst estimates of $1.97 billion. Arista Networks had a net margin of 40.72% and a return on equity of 29.91%. The company's quarterly revenue was up 27.6% compared to the same quarter last year. During the same period last year, the company posted $0.50 earnings per share. On average, equities analysts anticipate that Arista Networks will post 2.2 earnings per share for the current fiscal year.

Arista Networks declared that its board has authorized a share repurchase program on Tuesday, May 6th that allows the company to buyback $1.50 billion in outstanding shares. This buyback authorization allows the technology company to repurchase up to 1.3% of its stock through open market purchases. Stock buyback programs are typically a sign that the company's management believes its stock is undervalued.

Arista Networks Company Profile

(

Get Free ReportArista Networks, Inc engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Its cloud networking solutions consist of Extensible Operating System (EOS), a publish-subscribe state-sharing networking operating system offered in combination with a set of network applications.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Arista Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arista Networks wasn't on the list.

While Arista Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.