Arrowstreet Capital Limited Partnership acquired a new stake in Lindblad Expeditions Holdings, Inc. (NASDAQ:LIND - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund acquired 388,688 shares of the company's stock, valued at approximately $4,610,000. Arrowstreet Capital Limited Partnership owned about 0.71% of Lindblad Expeditions as of its most recent filing with the Securities & Exchange Commission.

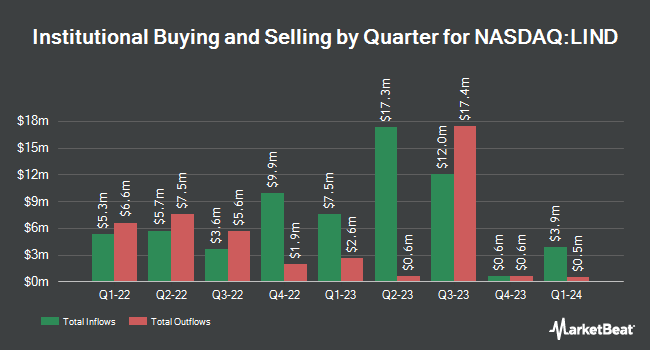

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in LIND. New York State Common Retirement Fund raised its holdings in Lindblad Expeditions by 3,496.6% in the fourth quarter. New York State Common Retirement Fund now owns 331,034 shares of the company's stock worth $3,926,000 after purchasing an additional 321,830 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. lifted its holdings in Lindblad Expeditions by 71.0% in the fourth quarter. Connor Clark & Lunn Investment Management Ltd. now owns 499,873 shares of the company's stock valued at $5,928,000 after acquiring an additional 207,581 shares during the period. Raymond James Financial Inc. purchased a new position in Lindblad Expeditions during the fourth quarter valued at $2,415,000. JPMorgan Chase & Co. raised its stake in Lindblad Expeditions by 59.4% during the 4th quarter. JPMorgan Chase & Co. now owns 514,214 shares of the company's stock worth $6,099,000 after acquiring an additional 191,546 shares during the period. Finally, Norges Bank bought a new position in Lindblad Expeditions in the 4th quarter worth $1,165,000. 75.94% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Separately, StockNews.com downgraded Lindblad Expeditions from a "buy" rating to a "hold" rating in a research note on Monday, March 3rd.

Get Our Latest Analysis on LIND

Lindblad Expeditions Price Performance

Shares of NASDAQ:LIND traded up $0.11 during trading hours on Friday, hitting $8.15. 320,850 shares of the company's stock traded hands, compared to its average volume of 308,076. The firm has a market capitalization of $444.88 million, a P/E ratio of -10.87 and a beta of 2.87. Lindblad Expeditions Holdings, Inc. has a 1 year low of $6.35 and a 1 year high of $14.34. The business has a fifty day moving average price of $10.55 and a 200-day moving average price of $11.20.

About Lindblad Expeditions

(

Free Report)

Lindblad Expeditions Holdings, Inc provides marine expedition adventures and travel experience worldwide. It operates through Lindblad and Land Experiences segment. Lindblad segment provides ship-based expeditions aboard customized, nimble, and intimately-scaled vessels, which offers up-close experiences in the planet's wild and remote places, and capitals of culture; and offers expedition ship which is equipped with state-of-the-art tools for in-depth exploration with infrastructure and ports, such as Antarctica and the Arctic, and places that accessed by a ship comprising Galápagos Islands, Alaska, Baja California's Sea of Cortez and Panama, and foster engagement activities.

Featured Stories

Before you consider Lindblad Expeditions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lindblad Expeditions wasn't on the list.

While Lindblad Expeditions currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.