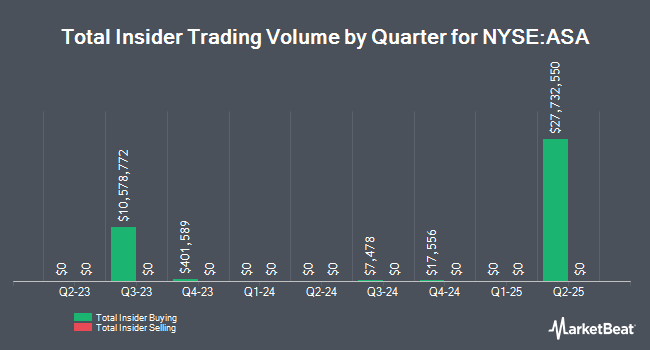

ASA Gold and Precious Metals Limited (NYSE:ASA - Get Free Report) major shareholder Saba Capital Management, L.P. acquired 35,777 shares of the business's stock in a transaction dated Friday, August 8th. The stock was acquired at an average price of $35.22 per share, with a total value of $1,260,065.94. Following the completion of the transaction, the insider directly owned 3,358,646 shares of the company's stock, valued at approximately $118,291,512.12. This represents a 1.08% increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Major shareholders that own more than 10% of a company's stock are required to disclose their sales and purchases with the SEC.

Saba Capital Management, L.P. also recently made the following trade(s):

- On Wednesday, August 13th, Saba Capital Management, L.P. purchased 1,836 shares of ASA Gold and Precious Metals stock. The stock was purchased at an average cost of $35.11 per share, for a total transaction of $64,461.96.

- On Tuesday, August 12th, Saba Capital Management, L.P. acquired 354,169 shares of ASA Gold and Precious Metals stock. The shares were bought at an average cost of $35.39 per share, for a total transaction of $12,534,040.91.

- On Monday, August 11th, Saba Capital Management, L.P. acquired 327,900 shares of ASA Gold and Precious Metals stock. The stock was purchased at an average price of $35.00 per share, for a total transaction of $11,476,500.00.

- On Thursday, August 7th, Saba Capital Management, L.P. purchased 69,032 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $34.73 per share, for a total transaction of $2,397,481.36.

ASA Gold and Precious Metals Trading Up 1.8%

Shares of ASA traded up $0.60 during mid-day trading on Friday, reaching $34.39. The company's stock had a trading volume of 119,692 shares, compared to its average volume of 132,520. ASA Gold and Precious Metals Limited has a 12-month low of $18.51 and a 12-month high of $35.60. The company's 50 day moving average is $32.91 and its 200 day moving average is $29.72.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the business. Sessa Capital IM L.P. grew its stake in ASA Gold and Precious Metals by 56.3% during the 1st quarter. Sessa Capital IM L.P. now owns 1,050,000 shares of the investment management company's stock worth $31,647,000 after buying an additional 378,327 shares during the last quarter. Capstone Investment Advisors LLC grew its stake in shares of ASA Gold and Precious Metals by 634.3% in the 4th quarter. Capstone Investment Advisors LLC now owns 266,221 shares of the investment management company's stock valued at $5,383,000 after purchasing an additional 229,968 shares during the last quarter. Medici Capital LLC purchased a new position in shares of ASA Gold and Precious Metals in the 2nd quarter valued at approximately $5,238,000. Cetera Investment Advisers grew its stake in shares of ASA Gold and Precious Metals by 223.9% in the 1st quarter. Cetera Investment Advisers now owns 188,855 shares of the investment management company's stock valued at $5,692,000 after purchasing an additional 130,547 shares during the last quarter. Finally, Sprott Inc. grew its stake in shares of ASA Gold and Precious Metals by 74.9% in the 1st quarter. Sprott Inc. now owns 280,183 shares of the investment management company's stock valued at $8,445,000 after purchasing an additional 120,000 shares during the last quarter.

About ASA Gold and Precious Metals

(

Get Free Report)

ASA Gold and Precious Metals Limited is a publicly owned investment manager. The firm invests in the public equity markets across the globe. It primarily invests in stocks of companies engaged in the exploration, mining or processing of gold, silver, platinum, diamonds, or other precious minerals. It also invests in exchange traded funds.

Further Reading

Before you consider ASA Gold and Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASA Gold and Precious Metals wasn't on the list.

While ASA Gold and Precious Metals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

We are about to experience the greatest A.I. boom in stock market history...

Thanks to a pivotal economic catalyst, specific tech stocks will skyrocket just like they did during the "dot com" boom in the 1990s.

That’s why, we’ve hand-selected 7 tiny tech disruptor stocks positioned to surge.

- The first pick is a tiny under-the-radar A.I. stock that's trading for just $3.00. This company already has 98 registered patents for cutting-edge voice and sound recognition technology... And has lined up major partnerships with some of the biggest names in the auto, tech, and music industry... plus many more.

- The second pick presents an affordable avenue to bolster EVs and AI development…. Analysts are calling this stock a “buy” right now and predict a high price target of $19.20, substantially more than its current $6 trading price.

- Our final and favorite pick is generating a brand-new kind of AI. It's believed this tech will be bigger than the current well-known leader in this industry… Analysts predict this innovative tech is gearing up to create a tidal wave of new wealth, fueling a $15.7 TRILLION market boom.

Right now, we’re staring down the barrel of a true once-in-a-lifetime moment. As an investment opportunity, this kind of breakthrough doesn't come along every day.

And the window to get in on the ground-floor — maximizing profit potential from this expected market surge — is closing quickly...

Simply enter your email below to get the names and tickers of the 7 small stocks with potential to make investors very, very happy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.