Zacks Research downgraded shares of ASM International (OTCMKTS:ASMIY - Free Report) from a hold rating to a strong sell rating in a research note issued to investors on Monday, August 25th,Zacks.com reports.

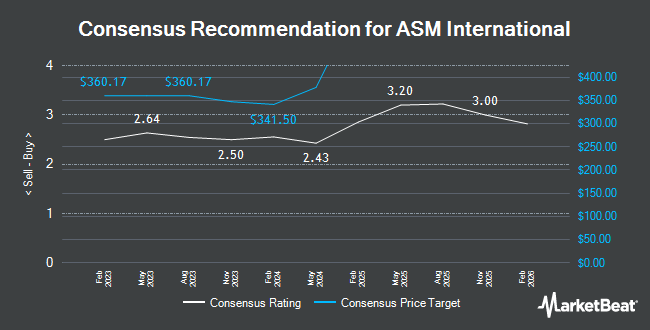

Several other research analysts have also commented on ASMIY. Barclays upgraded shares of ASM International from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, June 3rd. Hsbc Global Res upgraded shares of ASM International from a "hold" rating to a "strong-buy" rating in a research note on Friday, May 2nd. HSBC upgraded shares of ASM International to a "buy" rating in a research note on Friday, May 2nd. UBS Group upgraded shares of ASM International from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, May 21st. Finally, Jefferies Financial Group lowered shares of ASM International to a "hold" rating in a research note on Thursday, June 26th. Five investment analysts have rated the stock with a Strong Buy rating, two have assigned a Buy rating, two have assigned a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat.com, ASM International currently has an average rating of "Buy" and a consensus price target of $561.00.

Get Our Latest Stock Report on ASM International

ASM International Trading Down 4.0%

ASMIY stock traded down $20.16 during midday trading on Monday, reaching $480.00. The company had a trading volume of 10,355 shares, compared to its average volume of 6,506. ASM International has a 1 year low of $372.61 and a 1 year high of $680.51. The company has a market capitalization of $23.56 billion, a P/E ratio of 40.75 and a beta of 1.91. The company has a 50 day moving average of $541.45 and a two-hundred day moving average of $524.87.

ASM International (OTCMKTS:ASMIY - Get Free Report) last released its earnings results on Tuesday, July 22nd. The company reported $3.99 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.75 by ($0.76). ASM International had a return on equity of 20.14% and a net margin of 16.36%.The company had revenue of $979.62 million during the quarter, compared to analysts' expectations of $966.88 million. ASM International has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. On average, sell-side analysts anticipate that ASM International will post 14.46 earnings per share for the current year.

About ASM International

(

Get Free Report)

ASM International NV, together with its subsidiaries, engages in the research, development, manufacture, marketing, and servicing of equipment and materials used to produce semiconductor devices in Europe, the United States, and Asia. The company's products include wafer processing deposition systems for atomic layer deposition (ALD), epitaxy, silicon carbide, plasma enhanced chemical vapor deposition (PECVD), and vertical furnace systems, including low pressure chemical vapor deposition (LPCVD), diffusion, and oxidation products, as well as provides spare parts and support services.

Featured Stories

Before you consider ASM International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASM International wasn't on the list.

While ASM International currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.