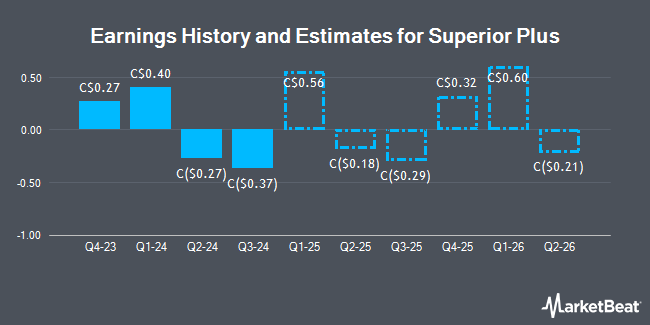

Superior Plus Corp. (TSE:SPB - Free Report) - Research analysts at Atb Cap Markets upped their FY2025 earnings per share (EPS) estimates for shares of Superior Plus in a report issued on Sunday, October 19th. Atb Cap Markets analyst N. Heywood now expects that the company will post earnings of $0.55 per share for the year, up from their previous estimate of $0.52.

SPB has been the topic of a number of other research reports. BMO Capital Markets lifted their price target on shares of Superior Plus from C$8.00 to C$10.00 in a research report on Friday, October 10th. TD Securities raised their price target on shares of Superior Plus from C$8.00 to C$9.00 and gave the stock a "hold" rating in a research report on Thursday, October 9th. Desjardins cut their price target on Superior Plus from C$10.50 to C$9.75 and set a "buy" rating for the company in a report on Wednesday, August 13th. Finally, Raymond James Financial reduced their price objective on Superior Plus from C$10.50 to C$10.00 and set an "outperform" rating for the company in a research report on Thursday, August 14th. One analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and two have assigned a Hold rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of C$9.53.

Check Out Our Latest Analysis on Superior Plus

Superior Plus Price Performance

Shares of TSE:SPB opened at C$7.89 on Tuesday. The company has a debt-to-equity ratio of 193.35, a current ratio of 0.67 and a quick ratio of 0.46. The stock has a market capitalization of C$1.76 billion, a P/E ratio of 37.57 and a beta of 0.21. The business has a 50-day moving average of C$7.57 and a two-hundred day moving average of C$7.46. Superior Plus has a fifty-two week low of C$5.15 and a fifty-two week high of C$8.34.

Superior Plus Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, October 15th. Stockholders of record on Wednesday, October 15th were issued a $0.045 dividend. The ex-dividend date was Monday, September 29th. This represents a $0.18 annualized dividend and a dividend yield of 2.3%. Superior Plus's dividend payout ratio (DPR) is presently 109.01%.

Superior Plus Company Profile

(

Get Free Report)

Superior is a leading North American distributor of propane, compressed natural gas, renewable energy and related products and services, servicing approximately 770,000 customer locations in the U.S. and Canada. Through its primary businesses, propane distribution and CNG, RNG and hydrogen distribution, Superior safely delivers clean burning fuels to residential, commercial, utility, agricultural and industrial customers not connected to a pipeline.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Superior Plus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Superior Plus wasn't on the list.

While Superior Plus currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.