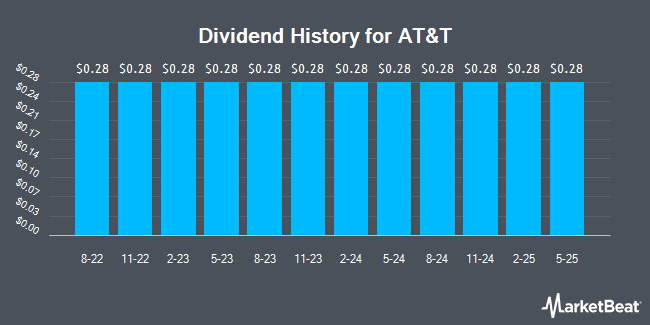

AT&T Inc. (NYSE:T - Get Free Report) declared a quarterly dividend on Thursday, September 25th, RTT News reports. Shareholders of record on Friday, October 10th will be paid a dividend of 0.2775 per share by the technology company on Monday, November 3rd. This represents a c) dividend on an annualized basis and a dividend yield of 3.9%.

AT&T has a payout ratio of 49.8% meaning its dividend is sufficiently covered by earnings. Analysts expect AT&T to earn $2.27 per share next year, which means the company should continue to be able to cover its $1.11 annual dividend with an expected future payout ratio of 48.9%.

AT&T Stock Down 0.0%

Shares of NYSE T traded down $0.01 during midday trading on Thursday, reaching $28.31. 25,618,064 shares of the company's stock were exchanged, compared to its average volume of 28,808,876. The company has a debt-to-equity ratio of 1.01, a quick ratio of 0.76 and a current ratio of 0.81. AT&T has a 52-week low of $21.05 and a 52-week high of $29.79. The business's fifty day moving average price is $28.58 and its two-hundred day moving average price is $27.86. The stock has a market capitalization of $202.42 billion, a PE ratio of 16.08, a price-to-earnings-growth ratio of 3.63 and a beta of 0.44.

AT&T (NYSE:T - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The technology company reported $0.54 EPS for the quarter, beating analysts' consensus estimates of $0.53 by $0.01. The business had revenue of $30.85 billion for the quarter, compared to analyst estimates of $30.44 billion. AT&T had a net margin of 10.29% and a return on equity of 13.36%. The business's revenue for the quarter was up 3.4% on a year-over-year basis. During the same quarter last year, the business earned $0.51 earnings per share. Analysts forecast that AT&T will post 2.14 EPS for the current year.

Analyst Upgrades and Downgrades

A number of analysts recently commented on the stock. UBS Group set a $33.00 price objective on shares of AT&T in a research report on Thursday, September 18th. HSBC downgraded shares of AT&T from a "buy" rating to a "hold" rating and set a $30.00 price objective for the company. in a research report on Thursday, July 24th. The Goldman Sachs Group assumed coverage on shares of AT&T in a research report on Tuesday, September 2nd. They set a "buy" rating and a $32.00 price objective for the company. Raymond James Financial reiterated a "strong-buy" rating and issued a $33.00 price target (up from $31.00) on shares of AT&T in a research report on Thursday, September 18th. Finally, Morgan Stanley boosted their price objective on shares of AT&T from $31.00 to $32.00 and gave the company an "overweight" rating in a research report on Wednesday, July 16th. One analyst has rated the stock with a Strong Buy rating, seventeen have issued a Buy rating and five have given a Hold rating to the company. Based on data from MarketBeat, AT&T has a consensus rating of "Moderate Buy" and an average target price of $30.74.

Check Out Our Latest Research Report on T

About AT&T

(

Get Free Report)

AT&T, Inc is a holding company, which engages in the provision of telecommunications and technology services. It operates through the Communications and Latin America segments. The Communications segment offers wireless, wireline telecom, and broadband services to businesses and consumers located in the US and businesses globally.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AT&T, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AT&T wasn't on the list.

While AT&T currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.