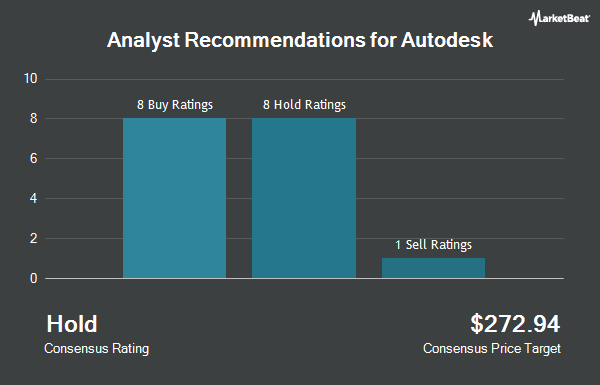

Autodesk, Inc. (NASDAQ:ADSK - Get Free Report) has been assigned a consensus rating of "Moderate Buy" from the twenty-four ratings firms that are covering the company, Marketbeat reports. Seven investment analysts have rated the stock with a hold recommendation and seventeen have issued a buy recommendation on the company. The average 12-month price target among brokerages that have issued a report on the stock in the last year is $356.8261.

A number of research analysts have issued reports on the company. Barclays lifted their price objective on Autodesk from $355.00 to $385.00 and gave the company an "overweight" rating in a report on Friday, August 29th. Stifel Nicolaus raised their target price on Autodesk from $350.00 to $375.00 and gave the company a "buy" rating in a research note on Friday, August 29th. Macquarie raised their target price on Autodesk from $360.00 to $380.00 and gave the company an "outperform" rating in a research note on Friday, August 29th. Royal Bank Of Canada raised their target price on Autodesk from $345.00 to $380.00 and gave the company an "outperform" rating in a research note on Friday, August 29th. Finally, Citigroup raised their target price on Autodesk from $376.00 to $393.00 and gave the company a "buy" rating in a research note on Tuesday, September 2nd.

Read Our Latest Research Report on ADSK

Autodesk Stock Down 1.7%

Shares of NASDAQ ADSK opened at $319.05 on Friday. The stock has a market cap of $67.96 billion, a PE ratio of 66.06, a PEG ratio of 2.88 and a beta of 1.49. The business has a fifty day moving average of $300.38 and a two-hundred day moving average of $286.67. Autodesk has a 52-week low of $232.67 and a 52-week high of $329.09. The company has a debt-to-equity ratio of 0.91, a quick ratio of 0.76 and a current ratio of 0.76.

Insiders Place Their Bets

In related news, EVP Steven M. Blum sold 22,420 shares of Autodesk stock in a transaction dated Friday, September 5th. The stock was sold at an average price of $323.75, for a total value of $7,258,475.00. Following the completion of the sale, the executive vice president directly owned 13,099 shares in the company, valued at $4,240,801.25. This trade represents a 63.12% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, EVP Ruth Ann Keene sold 2,761 shares of Autodesk stock in a transaction dated Wednesday, September 3rd. The stock was sold at an average price of $315.10, for a total value of $869,991.10. Following the completion of the sale, the executive vice president owned 80,255 shares of the company's stock, valued at approximately $25,288,350.50. The trade was a 3.33% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 43,860 shares of company stock valued at $14,045,061. 0.15% of the stock is owned by corporate insiders.

Institutional Trading of Autodesk

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Spire Wealth Management grew its position in shares of Autodesk by 2.5% during the 1st quarter. Spire Wealth Management now owns 2,075 shares of the software company's stock worth $543,000 after buying an additional 50 shares during the period. Sowell Financial Services LLC acquired a new position in shares of Autodesk during the 1st quarter worth about $324,000. Cambridge Investment Research Advisors Inc. grew its position in shares of Autodesk by 1.7% during the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 13,617 shares of the software company's stock worth $3,565,000 after buying an additional 229 shares during the period. Wealth Enhancement Advisory Services LLC grew its position in shares of Autodesk by 27.4% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 42,826 shares of the software company's stock worth $11,212,000 after buying an additional 9,222 shares during the period. Finally, GAMMA Investing LLC grew its position in shares of Autodesk by 5.4% during the 1st quarter. GAMMA Investing LLC now owns 5,617 shares of the software company's stock worth $1,471,000 after buying an additional 290 shares during the period. 90.24% of the stock is currently owned by institutional investors and hedge funds.

About Autodesk

(

Get Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.