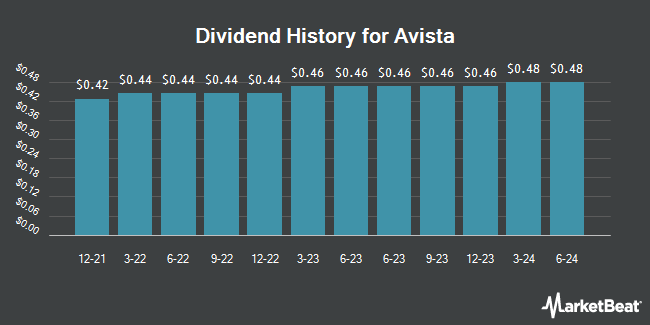

Avista Corporation (NYSE:AVA - Get Free Report) announced a quarterly dividend on Wednesday, August 6th, RTT News reports. Investors of record on Tuesday, August 19th will be paid a dividend of 0.49 per share by the utilities provider on Monday, September 15th. This represents a c) dividend on an annualized basis and a yield of 5.2%. The ex-dividend date of this dividend is Tuesday, August 19th.

Avista has a dividend payout ratio of 71.5% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect Avista to earn $2.53 per share next year, which means the company should continue to be able to cover its $1.96 annual dividend with an expected future payout ratio of 77.5%.

Avista Stock Performance

AVA stock traded down $0.06 during mid-day trading on Friday, reaching $37.38. 1,022,422 shares of the stock traded hands, compared to its average volume of 775,652. The company has a quick ratio of 0.68, a current ratio of 1.00 and a debt-to-equity ratio of 1.06. Avista has a 52 week low of $34.80 and a 52 week high of $43.09. The business has a 50-day moving average of $37.66 and a two-hundred day moving average of $38.75. The firm has a market capitalization of $3.03 billion, a PE ratio of 16.84, a P/E/G ratio of 2.47 and a beta of 0.40.

Avista (NYSE:AVA - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The utilities provider reported $0.17 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.28 by ($0.11). Avista had a net margin of 9.13% and a return on equity of 6.86%. The firm had revenue of $400.00 million for the quarter, compared to the consensus estimate of $416.06 million. During the same quarter last year, the company earned $0.29 earnings per share. As a group, equities analysts predict that Avista will post 2.3 EPS for the current fiscal year.

Insider Activity at Avista

In related news, VP Scott J. Kinney sold 1,024 shares of the stock in a transaction dated Thursday, June 12th. The shares were sold at an average price of $37.82, for a total value of $38,727.68. Following the completion of the sale, the vice president owned 11,515 shares in the company, valued at approximately $435,497.30. This trade represents a 8.17% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 0.94% of the company's stock.

Institutional Investors Weigh In On Avista

Several hedge funds have recently made changes to their positions in AVA. Ameritas Advisory Services LLC bought a new stake in shares of Avista in the second quarter valued at about $34,000. Bessemer Group Inc. lifted its stake in shares of Avista by 54.8% in the second quarter. Bessemer Group Inc. now owns 884 shares of the utilities provider's stock valued at $34,000 after buying an additional 313 shares during the period. GAMMA Investing LLC lifted its stake in shares of Avista by 252.3% in the first quarter. GAMMA Investing LLC now owns 916 shares of the utilities provider's stock valued at $38,000 after buying an additional 656 shares during the period. Caitong International Asset Management Co. Ltd bought a new stake in shares of Avista in the first quarter valued at about $43,000. Finally, Allworth Financial LP raised its position in Avista by 51.7% in the second quarter. Allworth Financial LP now owns 1,585 shares of the utilities provider's stock worth $60,000 after purchasing an additional 540 shares in the last quarter. Institutional investors own 85.24% of the company's stock.

About Avista

(

Get Free Report)

Avista Corporation, together with its subsidiaries, operates as an electric and natural gas utility company. It operates in two segments, Avista Utilities and AEL&P. The Avista Utilities segment provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho; and natural gas distribution services in parts of northeastern and southwestern Oregon, as well as generates electricity in Washington, Idaho, Oregon, and Montana.

Featured Articles

Before you consider Avista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avista wasn't on the list.

While Avista currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.