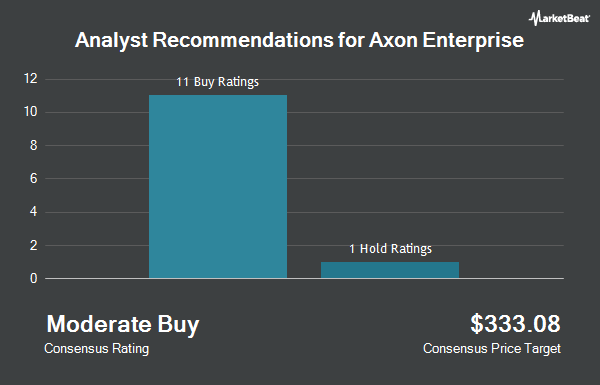

Axon Enterprise, Inc (NASDAQ:AXON - Get Free Report) has earned a consensus rating of "Moderate Buy" from the seventeen research firms that are presently covering the stock, Marketbeat reports. Three equities research analysts have rated the stock with a hold recommendation and fourteen have issued a buy recommendation on the company. The average 12 month target price among analysts that have issued a report on the stock in the last year is $841.6429.

A number of brokerages recently issued reports on AXON. Bank of America raised their price objective on Axon Enterprise from $895.00 to $1,000.00 and gave the stock a "buy" rating in a research report on Wednesday, August 6th. Raymond James Financial reissued an "outperform" rating and set a $855.00 price objective (up from $645.00) on shares of Axon Enterprise in a research report on Tuesday, August 5th. UBS Group reissued a "neutral" rating and set a $840.00 price objective (up from $820.00) on shares of Axon Enterprise in a research report on Tuesday, August 5th. Craig Hallum raised Axon Enterprise from a "hold" rating to a "buy" rating and set a $900.00 price objective for the company in a research report on Tuesday, August 5th. Finally, Northland Securities set a $800.00 price objective on Axon Enterprise in a research report on Tuesday, August 5th.

Read Our Latest Research Report on AXON

Insider Activity

In related news, Director Jeri Williams sold 100 shares of the firm's stock in a transaction dated Thursday, September 11th. The stock was sold at an average price of $752.54, for a total transaction of $75,254.00. Following the completion of the sale, the director directly owned 1,416 shares of the company's stock, valued at approximately $1,065,596.64. This trade represents a 6.60% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, President Joshua Isner sold 15,919 shares of the firm's stock in a transaction dated Friday, August 15th. The shares were sold at an average price of $746.26, for a total value of $11,879,712.94. Following the transaction, the president owned 238,379 shares of the company's stock, valued at $177,892,712.54. This trade represents a 6.26% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 49,932 shares of company stock worth $37,978,216. 4.40% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Axon Enterprise

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. boosted its position in Axon Enterprise by 3.5% in the 2nd quarter. Vanguard Group Inc. now owns 8,937,260 shares of the biotechnology company's stock valued at $7,399,515,000 after buying an additional 305,252 shares during the period. Geode Capital Management LLC grew its position in shares of Axon Enterprise by 5.9% during the second quarter. Geode Capital Management LLC now owns 2,072,186 shares of the biotechnology company's stock worth $1,713,332,000 after buying an additional 115,349 shares in the last quarter. Alliancebernstein L.P. grew its position in shares of Axon Enterprise by 15.9% during the first quarter. Alliancebernstein L.P. now owns 1,284,935 shares of the biotechnology company's stock worth $675,812,000 after buying an additional 175,890 shares in the last quarter. Westfield Capital Management Co. LP grew its position in shares of Axon Enterprise by 29.8% during the first quarter. Westfield Capital Management Co. LP now owns 927,801 shares of the biotechnology company's stock worth $487,977,000 after buying an additional 212,931 shares in the last quarter. Finally, Vestor Capital LLC grew its position in shares of Axon Enterprise by 438,636.3% during the second quarter. Vestor Capital LLC now owns 833,599 shares of the biotechnology company's stock worth $690,170,000 after buying an additional 833,409 shares in the last quarter. Hedge funds and other institutional investors own 79.08% of the company's stock.

Axon Enterprise Stock Down 0.9%

Shares of AXON opened at $711.34 on Thursday. Axon Enterprise has a 52-week low of $397.53 and a 52-week high of $885.91. The company has a market capitalization of $55.84 billion, a PE ratio of 175.64, a price-to-earnings-growth ratio of 27.87 and a beta of 1.42. The stock has a fifty day simple moving average of $757.95 and a two-hundred day simple moving average of $705.01. The company has a quick ratio of 2.71, a current ratio of 2.95 and a debt-to-equity ratio of 0.63.

Axon Enterprise (NASDAQ:AXON - Get Free Report) last issued its earnings results on Monday, August 4th. The biotechnology company reported $2.12 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.54 by $0.58. Axon Enterprise had a return on equity of 6.80% and a net margin of 13.64%.The business had revenue of $668.54 million during the quarter, compared to the consensus estimate of $641.77 million. During the same period last year, the company earned $1.20 EPS. The company's revenue for the quarter was up 32.6% on a year-over-year basis. Axon Enterprise has set its FY 2025 guidance at EPS. As a group, equities analysts forecast that Axon Enterprise will post 5.8 EPS for the current year.

About Axon Enterprise

(

Get Free Report)

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Axon Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axon Enterprise wasn't on the list.

While Axon Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.