Equities researchers at B. Riley assumed coverage on shares of Corsair Gaming (NASDAQ:CRSR - Get Free Report) in a report released on Wednesday, MarketBeat reports. The brokerage set a "neutral" rating and a $10.00 price target on the stock. B. Riley's price objective would suggest a potential upside of 25.47% from the stock's current price.

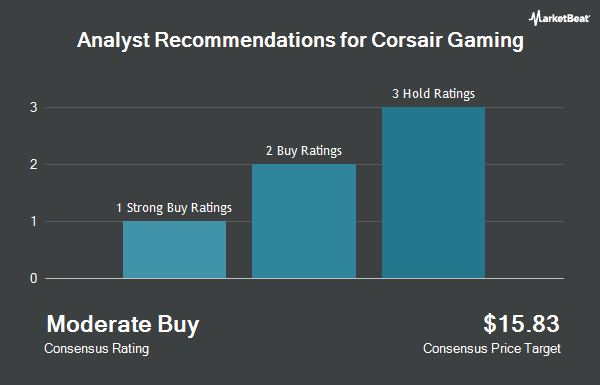

CRSR has been the topic of several other research reports. Barclays upgraded shares of Corsair Gaming to a "strong-buy" rating in a research report on Friday, August 8th. Wall Street Zen upgraded Corsair Gaming from a "hold" rating to a "buy" rating in a report on Friday, June 27th. One equities research analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating and four have given a Hold rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $9.86.

Get Our Latest Research Report on CRSR

Corsair Gaming Stock Down 7.9%

Shares of NASDAQ CRSR opened at $7.97 on Wednesday. The company has a current ratio of 1.45, a quick ratio of 0.75 and a debt-to-equity ratio of 0.20. Corsair Gaming has a 12 month low of $5.64 and a 12 month high of $13.02. The firm has a market capitalization of $845.14 million, a PE ratio of -9.84 and a beta of 1.76. The firm has a fifty day simple moving average of $8.81 and a two-hundred day simple moving average of $8.59.

Corsair Gaming (NASDAQ:CRSR - Get Free Report) last issued its quarterly earnings results on Thursday, August 7th. The company reported $0.01 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.01. Corsair Gaming had a negative net margin of 6.00% and a negative return on equity of 3.12%. The company had revenue of $320.11 million during the quarter, compared to analyst estimates of $312.38 million. During the same period last year, the business earned ($0.07) EPS. Corsair Gaming's quarterly revenue was up 22.5% compared to the same quarter last year. Corsair Gaming has set its FY 2025 guidance at EPS. Equities analysts expect that Corsair Gaming will post 0.22 earnings per share for the current year.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the business. Sunriver Management LLC purchased a new position in shares of Corsair Gaming in the 1st quarter valued at about $16,733,000. Driehaus Capital Management LLC purchased a new position in shares of Corsair Gaming in the 1st quarter valued at about $7,772,000. Alyeska Investment Group L.P. raised its position in shares of Corsair Gaming by 302.3% during the 1st quarter. Alyeska Investment Group L.P. now owns 914,879 shares of the company's stock worth $8,106,000 after acquiring an additional 687,477 shares in the last quarter. AQR Capital Management LLC raised its position in shares of Corsair Gaming by 328.9% during the 2nd quarter. AQR Capital Management LLC now owns 397,881 shares of the company's stock worth $3,752,000 after acquiring an additional 305,103 shares in the last quarter. Finally, Vanguard Group Inc. raised its position in shares of Corsair Gaming by 5.0% during the 1st quarter. Vanguard Group Inc. now owns 6,101,154 shares of the company's stock worth $54,056,000 after acquiring an additional 287,795 shares in the last quarter. Hedge funds and other institutional investors own 25.66% of the company's stock.

About Corsair Gaming

(

Get Free Report)

Corsair Gaming, Inc, together with its subsidiaries, designs, develops, markets, and sells gaming and streaming peripherals, components and systems in the Americas, Europe, the Middle East, and the Asia Pacific. It offers gamer and creator peripherals, including gaming keyboards, mice, headsets, controllers, and streaming products, such as capture cards, stream decks, microphones and audio interfaces, facecam streaming cameras, studio accessories, gaming furniture, and other related products.

Featured Stories

Before you consider Corsair Gaming, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corsair Gaming wasn't on the list.

While Corsair Gaming currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.