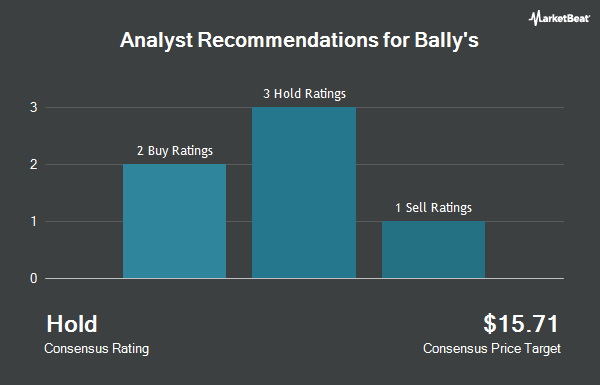

Shares of Bally's Corporation (NYSE:BALY - Get Free Report) have been assigned an average recommendation of "Hold" from the five research firms that are presently covering the firm, Marketbeat.com reports. Five investment analysts have rated the stock with a hold rating. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $11.00.

A number of research analysts recently commented on the stock. Barclays lowered their price objective on shares of Bally's from $13.00 to $11.00 and set an "equal weight" rating on the stock in a research report on Wednesday. Wall Street Zen raised shares of Bally's from a "sell" rating to a "hold" rating in a research note on Sunday. Truist Financial reduced their price objective on Bally's from $15.00 to $11.00 and set a "hold" rating for the company in a research report on Wednesday, July 16th. Stifel Nicolaus dropped their target price on Bally's from $12.00 to $10.00 and set a "hold" rating on the stock in a research report on Tuesday, August 12th. Finally, Macquarie lowered their price target on Bally's from $14.00 to $12.00 and set a "neutral" rating for the company in a research note on Tuesday, August 12th.

Read Our Latest Analysis on BALY

Bally's Stock Down 0.4%

NYSE:BALY traded down $0.04 during trading hours on Tuesday, hitting $9.37. 25,226 shares of the company's stock traded hands, compared to its average volume of 49,946. The stock's fifty day moving average price is $9.92 and its two-hundred day moving average price is $12.65. The firm has a market cap of $460.25 million, a P/E ratio of -0.80 and a beta of 1.86. The company has a debt-to-equity ratio of 5.54, a quick ratio of 0.47 and a current ratio of 0.49. Bally's has a twelve month low of $8.45 and a twelve month high of $23.20.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the company. JPMorgan Chase & Co. bought a new stake in Bally's in the 2nd quarter valued at $33,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. bought a new stake in shares of Bally's in the second quarter valued at about $38,000. BNP Paribas Financial Markets acquired a new stake in Bally's during the fourth quarter worth about $58,000. Bank of America Corp DE increased its stake in Bally's by 2,087.9% during the second quarter. Bank of America Corp DE now owns 7,942 shares of the company's stock valued at $76,000 after acquiring an additional 7,579 shares during the period. Finally, New York State Common Retirement Fund bought a new position in Bally's during the second quarter valued at about $97,000. Institutional investors own 70.41% of the company's stock.

Bally's Company Profile

(

Get Free Report)

Bally's Corp. is a global casino-entertainment company with a portfolio of casinos and resorts and online gaming businesses. It operates through the following segments: Casinos & Resorts, International Interactive, and North America Interactive. The Casinos & Resorts segment consists of the company's casino and resort properties, a horse racetrack, and a golf course.

Further Reading

Before you consider Bally's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bally's wasn't on the list.

While Bally's currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.