Graphic Packaging (NYSE:GPK - Get Free Report) had its target price dropped by equities research analysts at Bank of America from $31.00 to $28.00 in a report issued on Wednesday,Benzinga reports. The firm currently has a "buy" rating on the industrial products company's stock. Bank of America's price objective would indicate a potential upside of 24.89% from the stock's previous close.

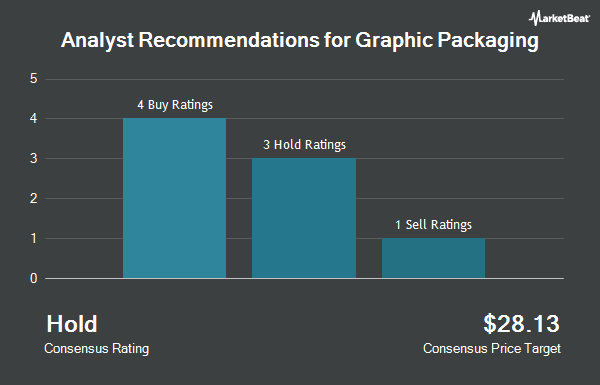

GPK has been the topic of several other reports. Royal Bank Of Canada decreased their target price on shares of Graphic Packaging from $26.00 to $25.00 and set an "outperform" rating on the stock in a research report on Wednesday, June 18th. Raymond James Financial reiterated an "outperform" rating and set a $26.00 target price (down from $30.00) on shares of Graphic Packaging in a research report on Friday, May 2nd. Truist Financial decreased their target price on shares of Graphic Packaging from $30.00 to $28.00 and set a "hold" rating on the stock in a research report on Tuesday, April 22nd. BNP Paribas Exane lowered shares of Graphic Packaging from an "outperform" rating to a "neutral" rating in a research report on Wednesday, June 25th. Finally, UBS Group started coverage on shares of Graphic Packaging in a research report on Wednesday, June 4th. They issued a "neutral" rating and a $24.00 price target on the stock. Six analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat, Graphic Packaging has a consensus rating of "Hold" and a consensus target price of $26.88.

Check Out Our Latest Report on Graphic Packaging

Graphic Packaging Price Performance

Shares of Graphic Packaging stock traded down $0.18 during trading on Wednesday, hitting $22.42. 2,084,966 shares of the company's stock traded hands, compared to its average volume of 2,610,145. The company has a debt-to-equity ratio of 1.80, a current ratio of 1.88 and a quick ratio of 0.73. The firm's fifty day moving average price is $22.15 and its 200 day moving average price is $24.83. Graphic Packaging has a twelve month low of $20.86 and a twelve month high of $30.70. The company has a market cap of $6.77 billion, a PE ratio of 10.94, a PEG ratio of 4.08 and a beta of 0.71.

Graphic Packaging (NYSE:GPK - Get Free Report) last issued its earnings results on Thursday, May 1st. The industrial products company reported $0.51 earnings per share for the quarter, missing the consensus estimate of $0.56 by ($0.05). Graphic Packaging had a net margin of 7.15% and a return on equity of 23.68%. The business had revenue of $2.12 billion for the quarter, compared to analyst estimates of $2.14 billion. During the same quarter last year, the firm posted $0.66 earnings per share. Graphic Packaging's revenue was down 6.2% on a year-over-year basis. Analysts forecast that Graphic Packaging will post 2.47 earnings per share for the current year.

Graphic Packaging declared that its board has approved a share buyback plan on Thursday, May 1st that permits the company to repurchase $1.50 billion in outstanding shares. This repurchase authorization permits the industrial products company to purchase up to 23.3% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's leadership believes its shares are undervalued.

Hedge Funds Weigh In On Graphic Packaging

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Vanguard Group Inc. raised its stake in shares of Graphic Packaging by 3.1% in the first quarter. Vanguard Group Inc. now owns 30,655,111 shares of the industrial products company's stock worth $795,807,000 after acquiring an additional 929,764 shares during the last quarter. American Century Companies Inc. raised its stake in shares of Graphic Packaging by 11.7% in the first quarter. American Century Companies Inc. now owns 18,488,501 shares of the industrial products company's stock worth $479,962,000 after acquiring an additional 1,932,841 shares during the last quarter. Fuller & Thaler Asset Management Inc. raised its stake in shares of Graphic Packaging by 5.7% in the fourth quarter. Fuller & Thaler Asset Management Inc. now owns 14,600,941 shares of the industrial products company's stock worth $396,562,000 after acquiring an additional 788,066 shares during the last quarter. Massachusetts Financial Services Co. MA raised its stake in shares of Graphic Packaging by 8.2% in the first quarter. Massachusetts Financial Services Co. MA now owns 10,351,192 shares of the industrial products company's stock worth $268,717,000 after acquiring an additional 781,509 shares during the last quarter. Finally, Victory Capital Management Inc. raised its stake in shares of Graphic Packaging by 1,004.9% in the first quarter. Victory Capital Management Inc. now owns 9,240,697 shares of the industrial products company's stock worth $239,888,000 after acquiring an additional 8,404,340 shares during the last quarter. 99.67% of the stock is currently owned by institutional investors and hedge funds.

About Graphic Packaging

(

Get Free Report)

Graphic Packaging Holding Company, together with its subsidiaries, designs, produces, and sells consumer packaging products to brands in food, beverage, foodservice, household, and other consumer products. It operates through three segments: Paperboard Manufacturing, Americas Paperboard Packaging, and Europe Paperboard Packaging.

See Also

Before you consider Graphic Packaging, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graphic Packaging wasn't on the list.

While Graphic Packaging currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.