Vipshop (NYSE:VIPS - Free Report) had its price target lowered by Bank of America from $17.80 to $17.30 in a research note published on Friday,Benzinga reports. The brokerage currently has a buy rating on the technology company's stock.

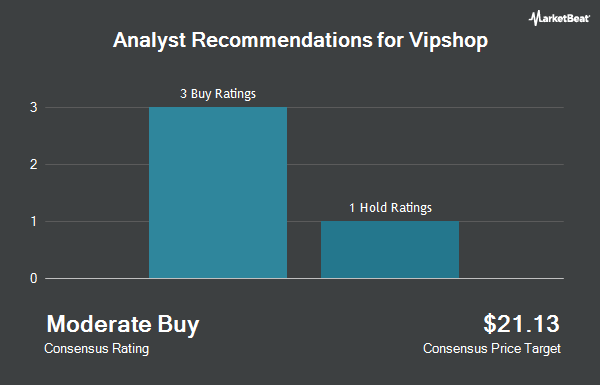

Several other brokerages have also recently issued reports on VIPS. Barclays dropped their target price on Vipshop from $20.00 to $19.00 and set an "overweight" rating on the stock in a research report on Thursday, May 22nd. Wall Street Zen lowered Vipshop from a "buy" rating to a "hold" rating in a research report on Thursday, May 29th. JPMorgan Chase & Co. decreased their target price on shares of Vipshop from $20.00 to $18.00 and set an "overweight" rating on the stock in a research report on Monday, June 30th. Finally, Citigroup cut shares of Vipshop from a "buy" rating to a "neutral" rating and set a $18.00 target price on the stock. in a research report on Tuesday, April 1st. Six analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat, Vipshop has a consensus rating of "Hold" and an average price target of $15.83.

Get Our Latest Stock Analysis on VIPS

Vipshop Stock Performance

Shares of VIPS traded up $0.13 during mid-day trading on Friday, hitting $15.93. 570,472 shares of the company traded hands, compared to its average volume of 3,614,056. The stock has a market cap of $8.17 billion, a price-to-earnings ratio of 8.33, a P/E/G ratio of 2.66 and a beta of 0.58. The stock has a 50-day moving average price of $14.82 and a two-hundred day moving average price of $14.64. Vipshop has a 1 year low of $11.50 and a 1 year high of $17.94.

Institutional Investors Weigh In On Vipshop

Several large investors have recently added to or reduced their stakes in the stock. Vinva Investment Management Ltd increased its position in Vipshop by 23.0% during the 4th quarter. Vinva Investment Management Ltd now owns 23,952 shares of the technology company's stock valued at $318,000 after purchasing an additional 4,472 shares during the period. Commonwealth of Pennsylvania Public School Empls Retrmt SYS raised its position in Vipshop by 5.6% during the 4th quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS now owns 432,552 shares of the technology company's stock worth $5,826,000 after buying an additional 22,849 shares during the last quarter. Summit Global Investments boosted its stake in shares of Vipshop by 10.2% in the fourth quarter. Summit Global Investments now owns 52,227 shares of the technology company's stock worth $703,000 after buying an additional 4,819 shares during the last quarter. American Century Companies Inc. boosted its stake in shares of Vipshop by 5.9% in the fourth quarter. American Century Companies Inc. now owns 1,478,944 shares of the technology company's stock worth $19,921,000 after buying an additional 82,989 shares during the last quarter. Finally, KLP Kapitalforvaltning AS purchased a new stake in shares of Vipshop in the fourth quarter worth about $2,000,000. 48.82% of the stock is owned by hedge funds and other institutional investors.

About Vipshop

(

Get Free Report)

Vipshop Holdings Limited operates online platforms in the People's Republic of China. It operates in Vip.com, Shan Shan Outlets, and Others segments. The company offers womenswear, menswear, sportswear and sporting goods, shoes and bags, accessories, baby and children products, skincare and cosmetics, home goods and other lifestyle products, and supermarket products.

Recommended Stories

Before you consider Vipshop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vipshop wasn't on the list.

While Vipshop currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.