First Quantum Minerals (TSE:FM - Free Report) had its target price hoisted by Barclays from C$21.60 to C$25.80 in a report issued on Wednesday morning,BayStreet.CA reports. Barclays currently has an outperform rating on the stock.

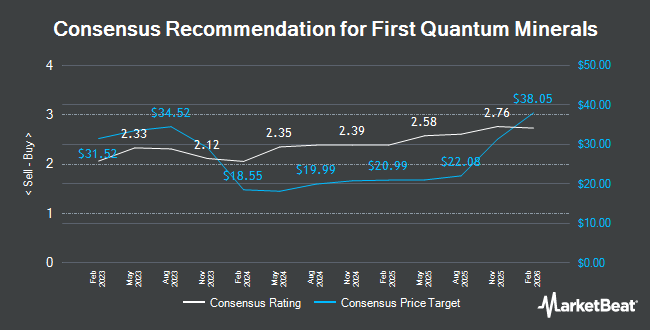

Other equities research analysts have also issued research reports about the company. Raymond James Financial raised First Quantum Minerals to a "hold" rating in a research note on Monday, June 30th. BMO Capital Markets raised First Quantum Minerals to a "strong-buy" rating in a research note on Tuesday, April 15th. Morgan Stanley dropped their price objective on First Quantum Minerals from C$19.70 to C$19.40 in a research note on Wednesday, April 9th. National Bankshares dropped their price objective on First Quantum Minerals from C$25.50 to C$24.00 and set an "outperform" rating for the company in a research note on Wednesday, April 16th. Finally, Royal Bank Of Canada lifted their price target on First Quantum Minerals from C$24.00 to C$25.00 and gave the stock an "outperform" rating in a research note on Wednesday, June 4th. Six analysts have rated the stock with a hold rating, four have assigned a buy rating and two have assigned a strong buy rating to the company. According to data from MarketBeat, First Quantum Minerals has an average rating of "Moderate Buy" and an average target price of C$22.05.

Get Our Latest Stock Analysis on First Quantum Minerals

First Quantum Minerals Stock Performance

Shares of First Quantum Minerals stock traded down C$0.05 during trading hours on Wednesday, reaching C$25.07. The company had a trading volume of 635,000 shares, compared to its average volume of 2,543,224. First Quantum Minerals has a one year low of C$13.81 and a one year high of C$25.96. The business has a fifty day simple moving average of C$20.97 and a 200 day simple moving average of C$19.49. The company has a debt-to-equity ratio of 56.41, a current ratio of 1.80 and a quick ratio of 1.41. The firm has a market cap of C$14.23 billion, a PE ratio of -9.27, a price-to-earnings-growth ratio of -1.28 and a beta of 1.73.

Insider Transactions at First Quantum Minerals

In other news, Director Alison Cheryl Beckett bought 1,029 shares of First Quantum Minerals stock in a transaction on Wednesday, July 2nd. The shares were purchased at an average price of C$24.59 per share, for a total transaction of C$25,307.84. 19.35% of the stock is currently owned by corporate insiders.

About First Quantum Minerals

(

Get Free Report)

First Quantum Minerals Ltd is a diversified mining company. The company's principal activities include mineral exploration, mine engineering and construction, and development and mining operations. The firm produces copper in concentrate, copper anode, copper cathode, nickel, gold, zinc, silver, acid, and pyrite.

Recommended Stories

Before you consider First Quantum Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Quantum Minerals wasn't on the list.

While First Quantum Minerals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.