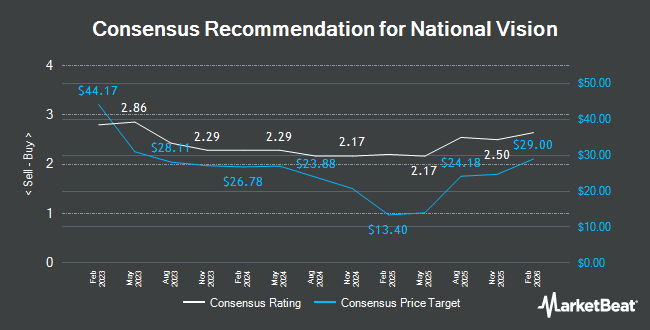

National Vision (NASDAQ:EYE - Get Free Report) had its target price reduced by analysts at Barclays from $30.00 to $28.00 in a research report issued on Thursday,Benzinga reports. The firm presently has an "overweight" rating on the stock. Barclays's price target would indicate a potential upside of 23.57% from the stock's current price.

A number of other equities research analysts also recently issued reports on the company. Wells Fargo & Company boosted their price target on National Vision from $15.00 to $24.00 and gave the company an "equal weight" rating in a research report on Wednesday, July 23rd. Roth Capital initiated coverage on National Vision in a research report on Wednesday, July 30th. They set a "buy" rating and a $36.00 price objective for the company. Citigroup upgraded shares of National Vision from a "neutral" rating to a "buy" rating and raised their price target for the stock from $13.00 to $21.00 in a report on Friday, May 9th. The Goldman Sachs Group increased their price objective on National Vision from $13.00 to $17.00 and gave the stock a "neutral" rating in a report on Friday, May 9th. Finally, Bank of America increased their target price on shares of National Vision from $22.00 to $26.00 and gave the stock a "buy" rating in a research report on Wednesday, June 18th. Four investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, National Vision currently has an average rating of "Moderate Buy" and an average target price of $24.73.

Check Out Our Latest Analysis on EYE

National Vision Stock Up 0.1%

Shares of EYE stock traded up $0.02 during mid-day trading on Thursday, reaching $22.66. 984,909 shares of the company's stock traded hands, compared to its average volume of 2,097,483. The company's 50-day moving average price is $23.52 and its 200-day moving average price is $16.89. The company has a quick ratio of 0.31, a current ratio of 0.52 and a debt-to-equity ratio of 0.30. The company has a market cap of $1.79 billion, a P/E ratio of -125.78, a P/E/G ratio of 2.73 and a beta of 1.27. National Vision has a 12 month low of $9.56 and a 12 month high of $25.67.

National Vision (NASDAQ:EYE - Get Free Report) last posted its earnings results on Wednesday, August 6th. The company reported $0.18 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.12 by $0.06. National Vision had a positive return on equity of 3.56% and a negative net margin of 0.75%. The company had revenue of $486.42 million for the quarter, compared to analyst estimates of $469.21 million. During the same quarter in the previous year, the firm earned $0.15 earnings per share. The firm's quarterly revenue was up 7.7% compared to the same quarter last year. On average, equities analysts expect that National Vision will post 0.31 earnings per share for the current fiscal year.

Insider Transactions at National Vision

In other National Vision news, SVP Ravi Acharya sold 12,000 shares of the firm's stock in a transaction that occurred on Tuesday, May 13th. The shares were sold at an average price of $18.75, for a total transaction of $225,000.00. Following the completion of the sale, the senior vice president directly owned 11,700 shares in the company, valued at $219,375. This trade represents a 50.63% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Corporate insiders own 2.70% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the business. Meeder Asset Management Inc. purchased a new stake in National Vision during the first quarter valued at approximately $35,000. Smartleaf Asset Management LLC lifted its position in National Vision by 69.3% during the first quarter. Smartleaf Asset Management LLC now owns 3,004 shares of the company's stock valued at $39,000 after acquiring an additional 1,230 shares during the last quarter. Tower Research Capital LLC TRC lifted its stake in shares of National Vision by 87.5% in the 4th quarter. Tower Research Capital LLC TRC now owns 7,050 shares of the company's stock valued at $73,000 after purchasing an additional 3,291 shares during the period. IFP Advisors Inc acquired a new position in National Vision during the second quarter worth $83,000. Finally, GAMMA Investing LLC raised its position in shares of National Vision by 49.2% in the first quarter. GAMMA Investing LLC now owns 7,318 shares of the company's stock valued at $94,000 after buying an additional 2,412 shares during the last quarter.

About National Vision

(

Get Free Report)

National Vision Holdings, Inc, through its subsidiaries, operates as an optical retailer in the United States. The company operates in two segments, Owned & Host and Legacy. It offers eyeglasses and contact lenses, and optical accessory products; provides eye exams through its America's Best, Eyeglass World, Vista Optical, Fred Meyer, and Vista Optical military, as well as Vision Center branded stores; and offers health maintenance organization and optometric services.

Featured Stories

Before you consider National Vision, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Vision wasn't on the list.

While National Vision currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.