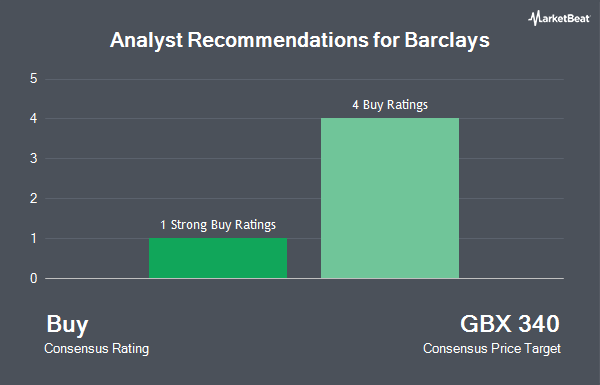

Shares of Barclays PLC (LON:BARC - Get Free Report) have been given an average recommendation of "Moderate Buy" by the five analysts that are presently covering the stock, Marketbeat.com reports. One equities research analyst has rated the stock with a hold recommendation and four have given a buy recommendation to the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is GBX 400.20.

Several research firms have weighed in on BARC. JPMorgan Chase & Co. reiterated an "overweight" rating on shares of Barclays in a research note on Wednesday, July 30th. Royal Bank Of Canada increased their price target on shares of Barclays from GBX 355 ($4.77) to GBX 435 ($5.85) and gave the stock an "outperform" rating in a research note on Tuesday, August 5th. Citigroup lowered shares of Barclays to a "neutral" rating and increased their price target for the stock from GBX 360 ($4.84) to GBX 366 ($4.92) in a research note on Friday, July 18th. Deutsche Bank Aktiengesellschaft restated a "buy" rating and set a GBX 380 ($5.11) price target on shares of Barclays in a research note on Wednesday, July 30th. Finally, Shore Capital increased their price target on shares of Barclays from GBX 395 ($5.31) to GBX 410 ($5.51) and gave the stock a "buy" rating in a research note on Tuesday, July 29th.

Check Out Our Latest Stock Report on BARC

Insider Buying and Selling

In other Barclays news, insider Dawn Fitzpatrick purchased 2,999 shares of the company's stock in a transaction that occurred on Wednesday, July 30th. The stock was acquired at an average cost of GBX 371 ($4.99) per share, with a total value of £11,126.29 ($14,964.75). Also, insider C.S. Venkatakrishnan purchased 44,562 shares of the company's stock in a transaction that occurred on Friday, June 20th. The shares were acquired at an average cost of GBX 326 ($4.38) per share, with a total value of £145,272.12 ($195,389.54). In the last 90 days, insiders purchased 98,837 shares of company stock valued at $33,407,827. Insiders own 1.47% of the company's stock.

Barclays Price Performance

BARC stock opened at GBX 367.95 ($4.95) on Friday. Barclays has a 12 month low of GBX 213.90 ($2.88) and a 12 month high of GBX 376.35 ($5.06). The firm has a 50 day simple moving average of GBX 340.59 and a 200 day simple moving average of GBX 311.89. The firm has a market cap of £52.83 billion, a PE ratio of 10.81, a P/E/G ratio of 1.15 and a beta of 1.36.

Barclays (LON:BARC - Get Free Report) last released its quarterly earnings results on Tuesday, July 29th. The financial services provider reported GBX 11.70 ($0.16) earnings per share (EPS) for the quarter. Barclays had a net margin of 19.54% and a return on equity of 6.97%. As a group, sell-side analysts expect that Barclays will post 39.1062802 earnings per share for the current year.

Barclays Company Profile

(

Get Free Report)

Barclays PLC provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia. The company operates through Barclays UK and Barclays International division segments. It offers financial services, such as retail banking, credit cards, wholesale banking, investment banking, wealth management, and investment management services.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Barclays, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barclays wasn't on the list.

While Barclays currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.