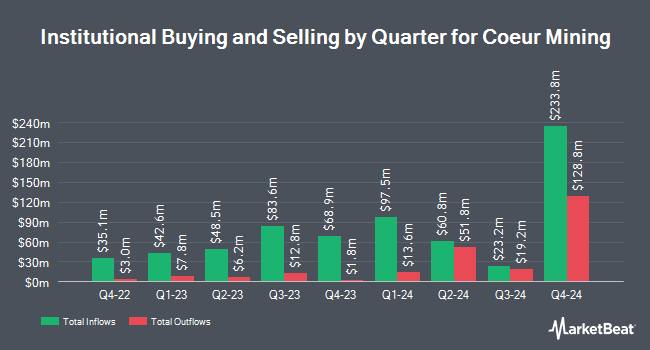

Bayesian Capital Management LP acquired a new position in Coeur Mining, Inc. (NYSE:CDE - Free Report) during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund acquired 47,800 shares of the basic materials company's stock, valued at approximately $273,000.

A number of other hedge funds have also recently bought and sold shares of CDE. GAMMA Investing LLC increased its position in shares of Coeur Mining by 139.8% during the 4th quarter. GAMMA Investing LLC now owns 5,761 shares of the basic materials company's stock worth $33,000 after purchasing an additional 3,359 shares in the last quarter. Quarry LP boosted its stake in Coeur Mining by 853.8% during the 4th quarter. Quarry LP now owns 6,667 shares of the basic materials company's stock worth $38,000 after acquiring an additional 5,968 shares during the last quarter. Optiver Holding B.V. grew its holdings in shares of Coeur Mining by 150.5% in the 4th quarter. Optiver Holding B.V. now owns 8,160 shares of the basic materials company's stock valued at $47,000 after buying an additional 4,903 shares during the period. FNY Investment Advisers LLC acquired a new position in shares of Coeur Mining in the 4th quarter valued at $57,000. Finally, DRW Securities LLC bought a new position in Coeur Mining in the fourth quarter valued at approximately $60,000. 63.01% of the stock is owned by institutional investors.

Coeur Mining Price Performance

Coeur Mining stock traded up $0.01 during trading hours on Tuesday, reaching $7.67. 6,352,730 shares of the stock were exchanged, compared to its average volume of 12,064,230. The company has a market cap of $4.90 billion, a P/E ratio of 63.92 and a beta of 1.24. The company has a current ratio of 0.83, a quick ratio of 0.39 and a debt-to-equity ratio of 0.50. Coeur Mining, Inc. has a twelve month low of $4.57 and a twelve month high of $7.85. The stock has a 50 day moving average of $5.88 and a two-hundred day moving average of $6.15.

Coeur Mining (NYSE:CDE - Get Free Report) last posted its quarterly earnings results on Wednesday, May 7th. The basic materials company reported $0.11 earnings per share for the quarter, beating analysts' consensus estimates of ($0.01) by $0.12. Coeur Mining had a net margin of 5.59% and a return on equity of 6.59%. During the same period in the prior year, the company posted ($0.05) EPS. The company's quarterly revenue was up 69.0% on a year-over-year basis. Equities analysts expect that Coeur Mining, Inc. will post 0.58 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities analysts have recently commented on the stock. TD Securities assumed coverage on shares of Coeur Mining in a research note on Tuesday, March 11th. They set a "buy" rating and a $7.00 price objective for the company. Cormark raised shares of Coeur Mining to a "moderate buy" rating in a research report on Thursday, February 20th. Roth Mkm dropped their price target on shares of Coeur Mining from $8.50 to $8.25 and set a "buy" rating on the stock in a research report on Friday, February 21st. Raymond James reaffirmed an "outperform" rating and set a $8.50 price target on shares of Coeur Mining in a research report on Wednesday, April 2nd. Finally, National Bank Financial raised shares of Coeur Mining to a "strong-buy" rating in a research report on Friday, March 21st. One investment analyst has rated the stock with a hold rating, five have given a buy rating and three have issued a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Buy" and a consensus target price of $8.10.

View Our Latest Analysis on Coeur Mining

Insider Activity at Coeur Mining

In other Coeur Mining news, CAO Kenneth J. Watkinson sold 12,350 shares of the firm's stock in a transaction that occurred on Friday, May 9th. The shares were sold at an average price of $7.40, for a total transaction of $91,390.00. Following the completion of the transaction, the chief accounting officer now owns 122,104 shares in the company, valued at approximately $903,569.60. This trade represents a 9.19% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Pierre Beaudoin sold 60,551 shares of the firm's stock in a transaction that occurred on Friday, May 9th. The stock was sold at an average price of $7.30, for a total transaction of $442,022.30. Following the sale, the director now directly owns 188,362 shares of the company's stock, valued at approximately $1,375,042.60. This trade represents a 24.33% decrease in their position. The disclosure for this sale can be found here. 1.50% of the stock is owned by company insiders.

About Coeur Mining

(

Free Report)

Coeur Mining, Inc explores for precious metals in the United States, Canada, and Mexico. The company primarily explores for gold, silver, zinc, and lead properties. It markets and sells its concentrates to third-party customers, smelters, under off-take agreements. The company was formerly known as Coeur d'Alene Mines Corporation and changed its name to Coeur Mining, Inc in May 2013.

See Also

Before you consider Coeur Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coeur Mining wasn't on the list.

While Coeur Mining currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.