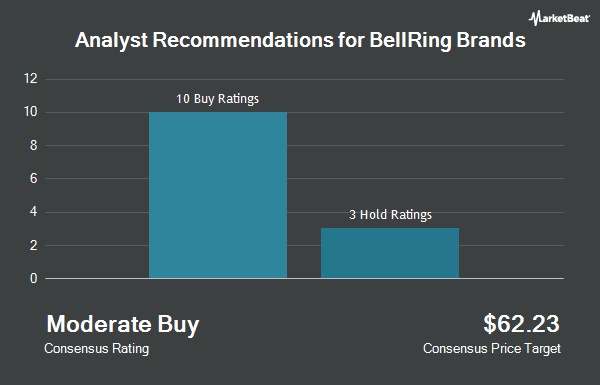

BellRing Brands Inc. (NYSE:BRBR - Get Free Report) has been given an average rating of "Moderate Buy" by the fifteen analysts that are covering the company, MarketBeat reports. Two investment analysts have rated the stock with a hold rating and thirteen have issued a buy rating on the company. The average twelve-month target price among brokerages that have issued a report on the stock in the last year is $64.80.

A number of equities research analysts have issued reports on BRBR shares. Barclays lowered their price target on BellRing Brands from $75.00 to $50.00 and set an "overweight" rating for the company in a research report on Thursday, August 7th. UBS Group lowered their price target on BellRing Brands from $63.00 to $40.00 and set a "neutral" rating for the company in a research report on Wednesday, August 6th. Truist Financial lowered their price target on BellRing Brands from $60.00 to $40.00 and set a "hold" rating for the company in a research report on Wednesday, August 6th. Stephens raised BellRing Brands from an "equal weight" rating to an "overweight" rating and lowered their price target for the company from $68.00 to $50.00 in a research report on Wednesday, August 6th. Finally, Evercore ISI lowered their price target on BellRing Brands from $82.00 to $64.00 and set an "outperform" rating for the company in a research report on Wednesday, August 6th.

Get Our Latest Research Report on BRBR

Insiders Place Their Bets

In other BellRing Brands news, CEO Darcy Horn Davenport sold 1,600 shares of the business's stock in a transaction dated Friday, August 1st. The stock was sold at an average price of $54.18, for a total transaction of $86,688.00. Following the transaction, the chief executive officer owned 193,978 shares in the company, valued at $10,509,728.04. The trade was a 0.82% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Shawn Conway acquired 2,700 shares of BellRing Brands stock in a transaction on Wednesday, August 6th. The shares were bought at an average price of $36.41 per share, for a total transaction of $98,307.00. Following the purchase, the director owned 6,685 shares of the company's stock, valued at $243,400.85. This represents a 67.75% increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last quarter, insiders have purchased 6,616 shares of company stock worth $65,995,248 and have sold 8,000 shares worth $450,272. 1.07% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Institutional investors have recently modified their holdings of the business. Mirae Asset Global Investments Co. Ltd. acquired a new position in shares of BellRing Brands in the first quarter worth about $280,000. GAMMA Investing LLC lifted its stake in shares of BellRing Brands by 12.2% in the first quarter. GAMMA Investing LLC now owns 2,316 shares of the company's stock worth $172,000 after acquiring an additional 252 shares in the last quarter. Robeco Institutional Asset Management B.V. lifted its stake in shares of BellRing Brands by 0.6% in the first quarter. Robeco Institutional Asset Management B.V. now owns 72,051 shares of the company's stock worth $5,365,000 after acquiring an additional 438 shares in the last quarter. Sumitomo Mitsui Trust Group Inc. lifted its stake in shares of BellRing Brands by 71.4% in the first quarter. Sumitomo Mitsui Trust Group Inc. now owns 8,883 shares of the company's stock worth $661,000 after acquiring an additional 3,700 shares in the last quarter. Finally, Janney Montgomery Scott LLC lifted its stake in shares of BellRing Brands by 31.6% in the first quarter. Janney Montgomery Scott LLC now owns 18,584 shares of the company's stock worth $1,384,000 after acquiring an additional 4,461 shares in the last quarter. Institutional investors and hedge funds own 94.97% of the company's stock.

BellRing Brands Stock Down 0.2%

Shares of NYSE:BRBR opened at $36.74 on Tuesday. The company has a market cap of $4.63 billion, a P/E ratio of 20.99, a P/E/G ratio of 1.83 and a beta of 0.74. BellRing Brands has a 52 week low of $34.02 and a 52 week high of $80.67. The business has a fifty day simple moving average of $41.78 and a 200-day simple moving average of $57.51.

BellRing Brands (NYSE:BRBR - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The company reported $0.55 EPS for the quarter, beating analysts' consensus estimates of $0.49 by $0.06. The business had revenue of $547.50 million during the quarter, compared to the consensus estimate of $530.76 million. BellRing Brands had a negative return on equity of 123.43% and a net margin of 10.26%.The business's revenue for the quarter was up 6.2% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.54 earnings per share. BellRing Brands has set its FY 2025 guidance at EPS. Sell-side analysts expect that BellRing Brands will post 2.23 earnings per share for the current fiscal year.

BellRing Brands declared that its Board of Directors has approved a share buyback program on Tuesday, September 2nd that authorizes the company to buyback $400.00 million in outstanding shares. This buyback authorization authorizes the company to buy up to 7.7% of its stock through open market purchases. Stock buyback programs are typically an indication that the company's board of directors believes its stock is undervalued.

About BellRing Brands

(

Get Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.