Onto Innovation (NYSE:ONTO - Get Free Report) had its price target lowered by Benchmark from $190.00 to $160.00 in a research note issued to investors on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the semiconductor company's stock. Benchmark's price target suggests a potential upside of 55.48% from the stock's current price.

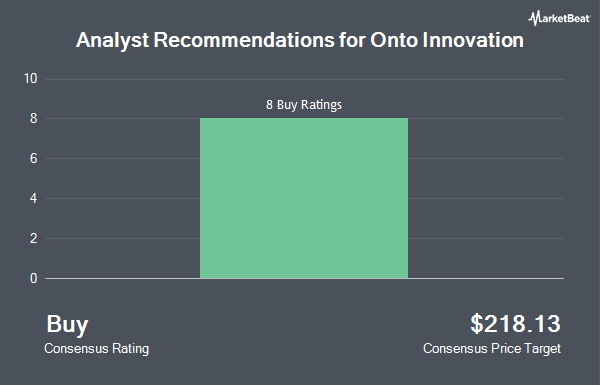

A number of other brokerages also recently issued reports on ONTO. B. Riley lowered their price target on Onto Innovation from $160.00 to $145.00 and set a "buy" rating on the stock in a report on Friday. Wall Street Zen raised Onto Innovation from a "sell" rating to a "hold" rating in a research note on Saturday, May 17th. Oppenheimer decreased their price objective on Onto Innovation from $150.00 to $130.00 and set an "outperform" rating on the stock in a research note on Friday, May 9th. Stifel Nicolaus decreased their price objective on Onto Innovation from $200.00 to $180.00 and set a "buy" rating on the stock in a research note on Tuesday, April 15th. Finally, Cantor Fitzgerald cut their target price on Onto Innovation from $110.00 to $90.00 and set a "neutral" rating for the company in a research report on Tuesday, June 24th. Three research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $137.86.

View Our Latest Stock Report on ONTO

Onto Innovation Trading Up 11.0%

Onto Innovation stock traded up $10.23 during trading on Friday, hitting $102.91. 1,430,661 shares of the company were exchanged, compared to its average volume of 1,239,092. The business's 50 day moving average is $98.08 and its 200 day moving average is $124.56. Onto Innovation has a 52 week low of $85.88 and a 52 week high of $228.42. The company has a market capitalization of $5.03 billion, a P/E ratio of 23.19, a PEG ratio of 0.58 and a beta of 1.44.

Onto Innovation (NYSE:ONTO - Get Free Report) last released its earnings results on Thursday, August 7th. The semiconductor company reported $1.25 EPS for the quarter, missing analysts' consensus estimates of $1.27 by ($0.02). The business had revenue of $253.60 million for the quarter, compared to the consensus estimate of $250.56 million. Onto Innovation had a return on equity of 14.85% and a net margin of 21.36%. The company's revenue for the quarter was up 4.7% on a year-over-year basis. During the same quarter in the previous year, the firm earned $1.32 earnings per share. Equities analysts expect that Onto Innovation will post 6.26 EPS for the current year.

Institutional Investors Weigh In On Onto Innovation

Institutional investors have recently modified their holdings of the stock. Concurrent Investment Advisors LLC bought a new stake in Onto Innovation during the 1st quarter valued at $217,000. GAMMA Investing LLC raised its position in Onto Innovation by 75.0% during the 1st quarter. GAMMA Investing LLC now owns 1,069 shares of the semiconductor company's stock valued at $130,000 after purchasing an additional 458 shares in the last quarter. Oppenheimer & Co. Inc. bought a new stake in Onto Innovation during the 1st quarter valued at $420,000. Oppenheimer Asset Management Inc. raised its position in Onto Innovation by 16.3% during the 1st quarter. Oppenheimer Asset Management Inc. now owns 7,211 shares of the semiconductor company's stock valued at $875,000 after purchasing an additional 1,013 shares in the last quarter. Finally, State of Alaska Department of Revenue increased its holdings in shares of Onto Innovation by 2.7% in the 1st quarter. State of Alaska Department of Revenue now owns 5,785 shares of the semiconductor company's stock valued at $701,000 after acquiring an additional 150 shares during the period. 98.35% of the stock is owned by institutional investors.

About Onto Innovation

(

Get Free Report)

Onto Innovation Inc engages in the design, development, manufacture, and support of process control tools that performs optical metrology. The company offers lithography systems and process control analytical software. It also offers process and yield management solutions, and device packaging and test facilities through standalone systems for optical metrology, macro-defect inspection, packaging lithography, and transparent and opaque thin film measurements.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Onto Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onto Innovation wasn't on the list.

While Onto Innovation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.