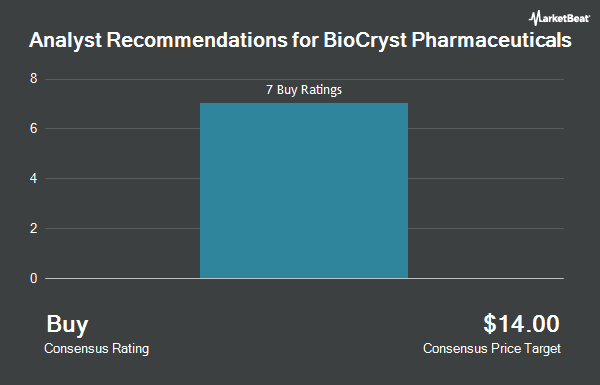

Shares of BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX - Get Free Report) have been given a consensus rating of "Moderate Buy" by the thirteen ratings firms that are presently covering the stock, Marketbeat reports. One analyst has rated the stock with a sell recommendation, two have given a hold recommendation, nine have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month target price among brokers that have issued a report on the stock in the last year is $19.1818.

A number of research firms have recently issued reports on BCRX. Bank of America boosted their price objective on BioCryst Pharmaceuticals from $13.00 to $15.00 and gave the company a "buy" rating in a research report on Tuesday, July 1st. JMP Securities boosted their price objective on BioCryst Pharmaceuticals from $17.00 to $27.00 and gave the company a "market outperform" rating in a research report on Wednesday, October 15th. Cantor Fitzgerald boosted their price target on BioCryst Pharmaceuticals from $24.00 to $26.00 and gave the company an "overweight" rating in a research note on Wednesday, October 15th. Needham & Company LLC boosted their price target on BioCryst Pharmaceuticals from $17.00 to $20.00 and gave the company a "buy" rating in a research note on Wednesday, October 15th. Finally, Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $13.00 price target on shares of BioCryst Pharmaceuticals in a research note on Monday, June 30th.

Read Our Latest Stock Report on BioCryst Pharmaceuticals

BioCryst Pharmaceuticals Stock Up 0.1%

Shares of NASDAQ BCRX opened at $7.20 on Friday. The business's 50 day moving average is $7.70 and its two-hundred day moving average is $8.64. The company has a market cap of $1.51 billion, a P/E ratio of -40.00 and a beta of 1.05. BioCryst Pharmaceuticals has a 12 month low of $6.00 and a 12 month high of $11.31.

BioCryst Pharmaceuticals (NASDAQ:BCRX - Get Free Report) last issued its quarterly earnings results on Monday, August 4th. The biotechnology company reported $0.15 EPS for the quarter, topping the consensus estimate of $0.03 by $0.12. The business had revenue of $163.35 million during the quarter, compared to the consensus estimate of $149.59 million. The business's quarterly revenue was up 49.5% on a year-over-year basis. During the same period in the prior year, the firm earned ($0.06) earnings per share. Sell-side analysts expect that BioCryst Pharmaceuticals will post -0.36 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, Director Theresa Heggie sold 70,000 shares of the business's stock in a transaction on Wednesday, August 13th. The stock was sold at an average price of $8.51, for a total value of $595,700.00. Following the sale, the director owned 65,352 shares of the company's stock, valued at $556,145.52. The trade was a 51.72% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 5.10% of the stock is currently owned by corporate insiders.

Institutional Trading of BioCryst Pharmaceuticals

Institutional investors have recently bought and sold shares of the stock. Headlands Technologies LLC acquired a new stake in BioCryst Pharmaceuticals in the 1st quarter valued at $32,000. GAMMA Investing LLC boosted its stake in BioCryst Pharmaceuticals by 1,161.8% in the first quarter. GAMMA Investing LLC now owns 5,918 shares of the biotechnology company's stock worth $44,000 after purchasing an additional 5,449 shares in the last quarter. New Age Alpha Advisors LLC acquired a new position in BioCryst Pharmaceuticals in the first quarter worth $62,000. Family Legacy Financial Solutions LLC acquired a new position in BioCryst Pharmaceuticals in the second quarter worth $72,000. Finally, Allspring Global Investments Holdings LLC acquired a new position in BioCryst Pharmaceuticals in the first quarter worth $79,000. Institutional investors and hedge funds own 85.88% of the company's stock.

BioCryst Pharmaceuticals Company Profile

(

Get Free Report)

BioCryst Pharmaceuticals, Inc, a biotechnology company, develops oral small-molecule and protein therapeutics to treat rare diseases. The company markets peramivir injection, an intravenous neuraminidase inhibitor for the treatment of acute uncomplicated influenza under the RAPIVAB, RAPIACTA, and PERAMIFLU names; and ORLADEYO, an oral serine protease inhibitor to treat hereditary angioedema.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BioCryst Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioCryst Pharmaceuticals wasn't on the list.

While BioCryst Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.