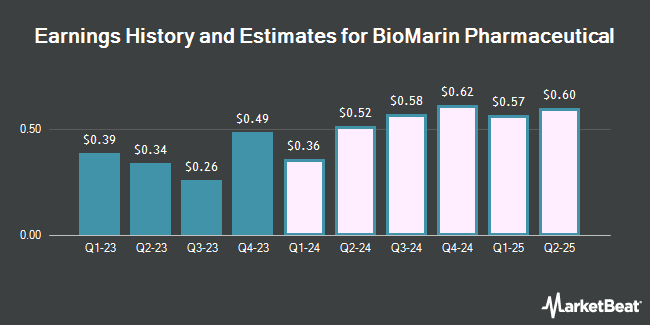

BioMarin Pharmaceutical (NASDAQ:BMRN - Get Free Report) issued an update on its FY 2025 earnings guidance on Monday morning. The company provided EPS guidance of 4.400-4.550 for the period, compared to the consensus EPS estimate of 3.451. The company issued revenue guidance of $3.1 billion-$3.2 billion, compared to the consensus revenue estimate of $3.1 billion.

BioMarin Pharmaceutical Stock Performance

NASDAQ:BMRN traded down $1.13 on Wednesday, hitting $60.80. The company's stock had a trading volume of 1,231,501 shares, compared to its average volume of 1,923,637. BioMarin Pharmaceutical has a one year low of $52.93 and a one year high of $94.85. The firm has a market capitalization of $11.66 billion, a P/E ratio of 18.05, a price-to-earnings-growth ratio of 0.83 and a beta of 0.18. The stock has a fifty day moving average of $57.24 and a two-hundred day moving average of $61.79. The company has a current ratio of 5.52, a quick ratio of 3.49 and a debt-to-equity ratio of 0.10.

Wall Street Analysts Forecast Growth

BMRN has been the topic of several research reports. Morgan Stanley decreased their price objective on shares of BioMarin Pharmaceutical from $97.00 to $96.00 and set an "overweight" rating on the stock in a report on Tuesday, July 22nd. Guggenheim upped their price target on shares of BioMarin Pharmaceutical from $101.00 to $106.00 and gave the company a "buy" rating in a research note on Wednesday. UBS Group increased their price target on shares of BioMarin Pharmaceutical from $113.00 to $114.00 and gave the company a "buy" rating in a report on Tuesday. Wedbush reissued an "outperform" rating and set a $94.00 price target on shares of BioMarin Pharmaceutical in a report on Tuesday. Finally, Citigroup lowered their price objective on BioMarin Pharmaceutical from $82.00 to $78.00 and set a "neutral" rating on the stock in a research report on Friday, May 2nd. Six investment analysts have rated the stock with a hold rating and twenty have issued a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $94.29.

Check Out Our Latest Stock Report on BioMarin Pharmaceutical

Insider Transactions at BioMarin Pharmaceutical

In other news, CAO Erin Burkhart sold 1,786 shares of BioMarin Pharmaceutical stock in a transaction on Tuesday, May 20th. The shares were sold at an average price of $59.31, for a total value of $105,927.66. Following the completion of the sale, the chief accounting officer owned 14,173 shares in the company, valued at $840,600.63. The trade was a 11.19% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Company insiders own 0.85% of the company's stock.

Institutional Trading of BioMarin Pharmaceutical

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in BMRN. NewEdge Advisors LLC grew its stake in BioMarin Pharmaceutical by 11.5% in the first quarter. NewEdge Advisors LLC now owns 3,769 shares of the biotechnology company's stock valued at $266,000 after acquiring an additional 388 shares during the period. Focus Partners Wealth grew its position in BioMarin Pharmaceutical by 70.2% in the 1st quarter. Focus Partners Wealth now owns 11,817 shares of the biotechnology company's stock valued at $835,000 after purchasing an additional 4,876 shares during the period. Finally, Empowered Funds LLC increased its stake in BioMarin Pharmaceutical by 207.4% during the 1st quarter. Empowered Funds LLC now owns 12,023 shares of the biotechnology company's stock valued at $850,000 after purchasing an additional 8,112 shares in the last quarter. 98.71% of the stock is owned by institutional investors.

BioMarin Pharmaceutical Company Profile

(

Get Free Report)

BioMarin Pharmaceutical Inc develops and commercializes therapies for people with serious and life-threatening rare diseases and medical conditions. Its commercial products include Vimizim, an enzyme replacement therapy for the treatment of mucopolysaccharidosis (MPS) IV type A, a lysosomal storage disorder; Naglazyme, a recombinant form of N-acetylgalactosamine 4-sulfatase for patients with MPS VI; and Kuvan, a proprietary synthetic oral form of 6R-BH4 that is used to treat patients with phenylketonuria (PKU), an inherited metabolic disease.

See Also

Before you consider BioMarin Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioMarin Pharmaceutical wasn't on the list.

While BioMarin Pharmaceutical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.