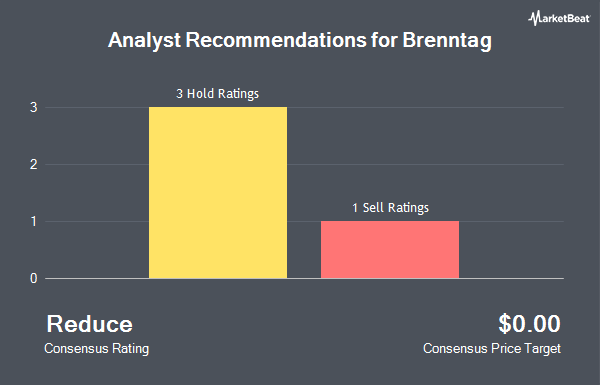

Brenntag AG (OTCMKTS:BNTGY - Get Free Report) has been assigned a consensus rating of "Reduce" from the six research firms that are presently covering the firm, Marketbeat Ratings reports. Two investment analysts have rated the stock with a sell rating and four have assigned a hold rating to the company.

A number of analysts recently commented on BNTGY shares. Deutsche Bank Aktiengesellschaft restated a "hold" rating on shares of Brenntag in a research note on Wednesday, September 24th. UBS Group cut shares of Brenntag from a "hold" rating to a "sell" rating in a research report on Friday, October 10th. Finally, Berenberg Bank lowered shares of Brenntag from a "strong-buy" rating to a "hold" rating in a report on Thursday, July 3rd.

Check Out Our Latest Report on BNTGY

Brenntag Stock Performance

Shares of BNTGY stock opened at $11.64 on Friday. Brenntag has a 52-week low of $10.93 and a 52-week high of $14.82. The company has a 50-day simple moving average of $12.09 and a two-hundred day simple moving average of $12.75. The company has a market capitalization of $8.40 billion, a price-to-earnings ratio of 18.19 and a beta of 0.85.

Brenntag (OTCMKTS:BNTGY - Get Free Report) last released its earnings results on Wednesday, August 13th. The company reported $0.07 earnings per share for the quarter, missing analysts' consensus estimates of $0.22 by ($0.15). Brenntag had a net margin of 2.62% and a return on equity of 9.19%. The company had revenue of $4.39 billion for the quarter, compared to the consensus estimate of $4.14 billion. On average, sell-side analysts forecast that Brenntag will post 0.9 EPS for the current fiscal year.

Brenntag Company Profile

(

Get Free Report)

Brenntag SE purchases and supplies various industrial and specialty chemicals, and ingredients in Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific. The company operates in two segments, Brenntag Essentials and Brenntag Specialties. It provides just-in-time delivery, product mixing, blending, repackaging, inventory management, and drum return handling.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Brenntag, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brenntag wasn't on the list.

While Brenntag currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.