Berenberg Bank cut shares of Brenntag (OTCMKTS:BNTGY - Free Report) from a strong-buy rating to a hold rating in a research note issued to investors on Thursday,Zacks.com reports.

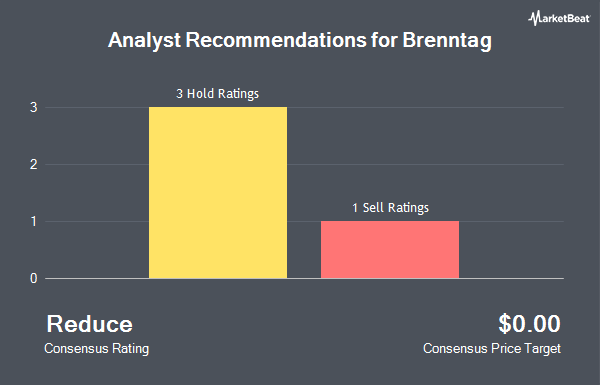

Separately, DZ Bank downgraded shares of Brenntag from a "strong-buy" rating to a "strong sell" rating in a research report on Thursday, May 15th. One research analyst has rated the stock with a sell rating and four have given a hold rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Hold".

Get Our Latest Analysis on Brenntag

Brenntag Stock Performance

Brenntag stock traded down $0.37 during midday trading on Thursday, reaching $12.84. 13,821 shares of the company's stock were exchanged, compared to its average volume of 60,613. The stock's 50-day simple moving average is $13.44 and its 200 day simple moving average is $12.98. The firm has a market cap of $9.27 billion, a price-to-earnings ratio of 16.25 and a beta of 0.87. Brenntag has a 52 week low of $11.09 and a 52 week high of $15.07.

Brenntag (OTCMKTS:BNTGY - Get Free Report) last issued its earnings results on Wednesday, May 14th. The company reported $0.20 EPS for the quarter, missing the consensus estimate of $0.24 by ($0.04). Brenntag had a return on equity of 11.47% and a net margin of 3.24%. Research analysts forecast that Brenntag will post 0.9 earnings per share for the current year.

Brenntag Increases Dividend

The company also recently announced a dividend, which was paid on Wednesday, June 11th. Stockholders of record on Monday, May 26th were issued a dividend of $0.2696 per share. The ex-dividend date of this dividend was Friday, May 23rd. This represents a dividend yield of 2%. This is an increase from Brenntag's previous dividend of $0.05. Brenntag's dividend payout ratio (DPR) is currently 34.18%.

Brenntag Company Profile

(

Get Free Report)

Brenntag SE purchases and supplies various industrial and specialty chemicals, and ingredients in Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific. The company operates in two segments, Brenntag Essentials and Brenntag Specialties. It provides just-in-time delivery, product mixing, blending, repackaging, inventory management, and drum return handling.

Further Reading

Before you consider Brenntag, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brenntag wasn't on the list.

While Brenntag currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.