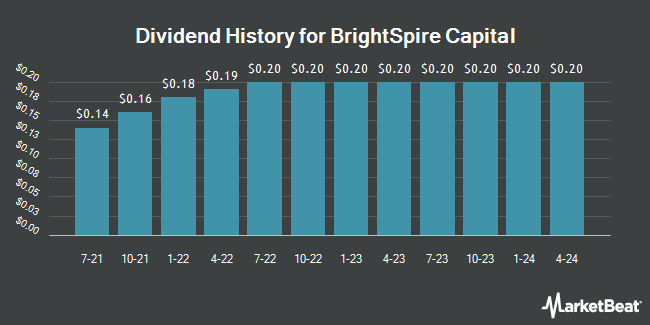

BrightSpire Capital, Inc. (NYSE:BRSP - Get Free Report) declared a quarterly dividend on Monday, September 15th, RTT News reports. Investors of record on Tuesday, September 30th will be given a dividend of 0.16 per share on Wednesday, October 15th. This represents a c) annualized dividend and a dividend yield of 11.0%. The ex-dividend date is Tuesday, September 30th.

BrightSpire Capital has a payout ratio of 90.1% indicating that its dividend is currently covered by earnings, but may not be in the future if the company's earnings tumble.

BrightSpire Capital Price Performance

BRSP traded up $0.04 during trading on Friday, hitting $5.81. The company's stock had a trading volume of 1,817,811 shares, compared to its average volume of 576,667. The stock has a market capitalization of $754.59 million, a price-to-earnings ratio of -26.39 and a beta of 1.61. BrightSpire Capital has a 12 month low of $4.16 and a 12 month high of $6.45. The company has a quick ratio of 0.54, a current ratio of 0.54 and a debt-to-equity ratio of 1.79. The firm's 50 day moving average price is $5.48 and its two-hundred day moving average price is $5.31.

BrightSpire Capital Company Profile

(

Get Free Report)

BrightSpire Capital, Inc operates as a commercial real estate (CRE) credit real estate investment trust in the United States and Europe. The company operates through Senior and Mezzanine Loans and Preferred Equity; Net Leased and Other Real Estate; and Corporate and Other segments. It focuses on originating, acquiring, financing, and managing a diversified portfolio of CRE debt investments consisting of first mortgage loans, senior loans, debt securities, mezzanine loans, and preferred equity investments, as well as net leased properties.

Featured Stories

Before you consider BrightSpire Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightSpire Capital wasn't on the list.

While BrightSpire Capital currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.